The very big picture (a historical perspective):

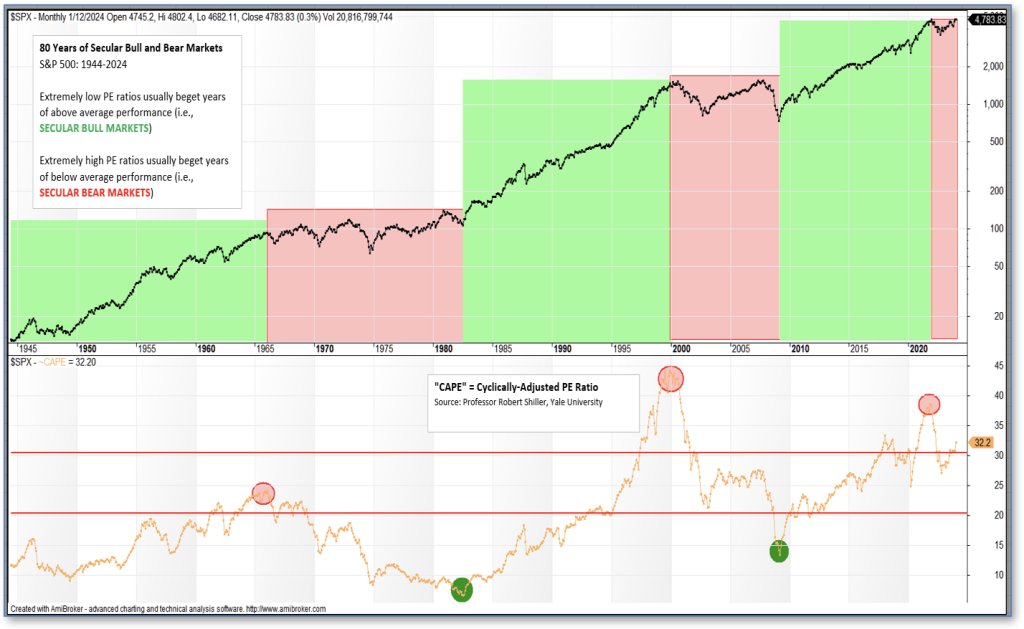

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears.

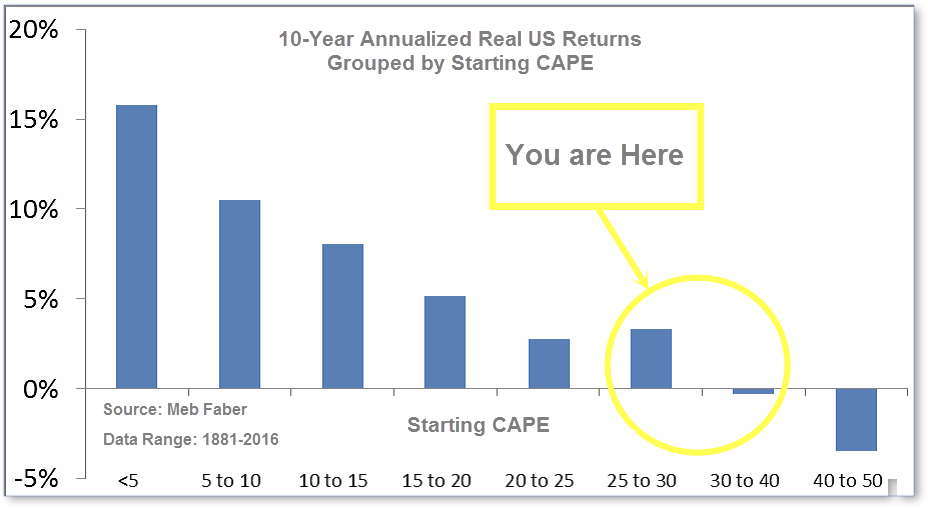

The CAPE is now at 33.69, down from the prior week’s 33.83. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our DELTA-V Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that all of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: The major indexes sold off early in the week after the Labor Department reported higher than expected consumer prices. The declines were mostly concentrated in large-cap growth stocks. Meanwhile, the small-cap Russell 2000 Index rebounded to lead the gains for the week. The Dow Jones Industrial Average ticked down -0.1% as it moved from last week’s close of 38,672 to this week’s close of 38,628. The technology-heavy NASDAQ retreated -1.3%. By market cap, the large cap S&P 500 shed -0.4%, while the mid cap S&P 400 rose 0.7%. The small cap Russell 2000 gained 1.1%, closing at 2,033.

International Markets: The international indexes ended the week in the green. Canada’s TSX added 1.2%, while the UK’s FTSE 100 climbed 1.8%. France’s CAC 40 rose 1.6%, whereas Germany’s DAX ticked up 1.1%. In Asia, China’s stock market was closed all week due to the country’s New Year holiday period. Japan’s Nikkei advanced 4.3%. As grouped by Morgan Stanley Capital International, developed markets ticked up 1.0%, while emerging markets rose by 1.3%.

Commodities:Precious metals were mixed this week. Gold ticked down -0.72% to $2,024.10 an ounce. Meanwhile, silver climbed 3.90% to $23.48 an ounce. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, advanced 4.30%. West Texas Intermediate crude oil rose 2.10% to $78.46 per barrel.

U.S. Economic News: The consumer price index, a broad-based measure of the prices for goods and services across the economy, increased by 0.3% last month, the Bureau of Labor Statistics reported. Economists surveyed by Dow Jones had forecasted a monthly increase of 0.2%. The core rate of inflation, which excludes food and energy, gained 0.4% in January. Meanwhile, the annual rate of core inflation held unchanged at 3.9%. The increase in the index was largely concentrated in shelter prices, which comprise approximately one-third of the CPI weighting. Food prices gained 0.4% on the month. “The much-anticipated CPI report is a disappointment for those who expected inflation to edge lower allowing the Fed to begin easing rates sooner rather than later,” said Quincy Krosby, chief global strategist at LPL Financial.

The producer-price index increased by 0.3% last month. The producer-price index report indicates the expenses companies incur for supplies like fuel and packaging, which tend to affect the costs customers pay at the retail level. Core wholesale prices, which omit food and energy, rose by 0.6% in January. The increase in wholesale inflation over the past 12 months declined slightly from 1% to 0.9%. Meanwhile, the year-on-year rate of core wholesale inflation was essentially unchanged at 2.6%. “Two strong inflation reports show why the Fed is going to need to move much more slowly to cut interest rates,” said Chris Zaccarelli, chief investment officer at the Independent Advisor Alliance.

The number of Americans who applied for unemployment benefits declined to 212,000, suggesting that layoffs have remained relatively low. The government reported that initial jobless claims decreased by 8,000 last week. Economists had forecasted new claims to total 220,000, based on seasonally adjusted figures. Meanwhile, the number of individuals collecting unemployment benefits in the U.S. added 30,000 to a total of 1.9 million. Looking at unadjusted figures, initial jobless claims remained lower than they were a year ago. “The dichotomy between exceptionally low initial claims and the recent rise in continuing claims suggests that the U.S. labor market is slowing, and that workers who lose their jobs are having a more difficult time finding new work,” said Stuart Hoffman, economic advisor of PNC Financial Services.

Retail sales, which represent roughly a third of consumer spending, declined by 0.8% in January, according to the Census Bureau. Economists had forecasted a 0.2% decline. Sales at building materials and garden stores were down 4.1%, while motor vehicle parts and retailers saw a 1.7% decrease in sales. However, sales at restaurants and bars reported a rise of 0.7%. “It’s a weak report, but not a fundamental shift in consumer spending,” said Robert Frick, corporate economist for Navy Federal Credit Union. “December was high due to holiday shopping, and January saw drops in those spending categories, plus frigid weather plus an unfavorable seasonal adjustment. Consumer spending likely won’t be great this year, but with real wage gains and increasing employment it should be plenty to help keep the economy expanding,” Frick added.

Housing starts fell from 1.56 million in December to an annual pace of 1.33 million, the government said. Economists expected a rate of 1.45 million. The pace of construction of new U.S. homes fell by 14.8% in January. Construction for multi-family houses registered a fall of nearly 36%. Builders scaled back construction of new single-family homes as well, which led to a 4.7% drop. Apartments registered a fall of 35.8%. Building permits, which offer an indication of future construction, fell by 1.5% to a rate of 1.47 million. The Northeast was the only region with an increase in construction, where single-family starts rose 26.7%. “Housing starts fell by the largest amount since April 2020 in January, led by a huge drop in multi-family starts. We suspect the multi-family sector will continue to be a drag on new development this year, given the huge number of multi-family units already under construction,” property economist at Capital Economics, Thomas Ryan, wrote in a note.

International Economic News: In Canada, Finance Minister Chrystia Freeland said the Canadian government will prioritize lowering interest rates from a 22-year high of 5%. In his testimony to the House of Commons finance committee, Bank of Canada Governor Tiff Macklem said major spending increases in the upcoming budget could potentially hinder efforts to decrease inflation. In the four prior meetings, the Bank of Canada held borrowing costs unchanged at 5%. While this helped lower the inflation rate from 8.1% in 2022 to 3.4% in December 2023, it has led to elevated mortgage costs, house prices, as well as rents. “We definitely are conscious of our priority, when it comes to economic policy, of acting in such a way that creates conditions that will make it possible for interest rates to come down,” Freeland said.

Across the Atlantic, British retail sales surged in January as consumers recovered their appetite for spending. According to the Office for National Statistics, sales volumes increased by 3.4% from December, which surpassed economists’ median forecast of a 1.5% increase. Data this week indicated Britain’s economy had slipped into a recession in the second half of 2023. Wage growth slowed in the final quarter of last year but remained steady as employers struggled to fill vacancies. The Office for National Statistics said clothing sales had dropped by 1.4% month-on-month, which was the only sub-category to fall in January. “Overall, today’s release was stronger than expected and suggests the drag from higher interest rates on consumer spending is fading fast and points to the economy soon moving out of recession,” Joe Maher, an economist with Capital Economics said.

On Europe’s mainland, the German Chamber of Commerce and Industry (DIHK) warned that the German economy would shrink by 0.5% this year. A DIHK poll of over 27,000 companies showed that 35% expect business to shrink in the next 12 months as high energy prices and weak domestic demand weigh on economic output. “The bad mood among companies is becoming more entrenched,” said the DIHK in Berlin this week. Chancellor Olaf Scholz linked Germany’s weak economic performance with the sluggish global economy. Scholz added that new batteries, chips, cars, and pharmaceutical plants would be built in Germany and help the country remain an attractive location for new large-scale projects. According to economist Clemens Fuest, head of the Munich-based Ifo institute, the high level of uncertainty about the future course of economic and climate policy had contributed to Germany’s weak growth. “A central problem is that the federal government does not have a convincing medium-term growth strategy,” Fuest said.

In France, Finance Minister Bruno Le Maire said the government’s official growth forecast will be revised as the outlook for European countries worsened. “In Europe, we have a growth rate that is well below the US and all the European states are revising their growth forecasts,” Le Maire said. The 2024 government budget is predicated on a 1.4% increase in gross domestic product for this year. However, international institutions have recently slashed their forecasts well below that mark. The European Commission announced it anticipates only 0.9% growth in France this year. A decline in output would require the government to implement additional cost-saving measures to remain on track with its plans to contain the budget deficit. Furthermore, the government is relying upon stronger expansion to support a labor market that began to weaken in 2023. Le Maire said Europe also faces fundamental economic challenges beyond the current headwinds from inflation and increased borrowing costs. “Europe has a structural problem with growth, with a lack of productivity that creates fewer jobs and fewer opportunities for European citizens,” Le Maire said.

In Asia, China’s Year of the Dragon boosted consumer spending and travel during the holiday period. According to China’s culture and tourism ministry, there were 474 million domestic trips during the eight-day lunar new year festival, which marked a 34% year-on-year increase. Tourists spent ¥633 billion ($89 billion) during the holiday period, which was 47% higher from the prior year. Hong Kong, which hosted its HK $13 million ($1.7 million) firework display, lodged 750,000 visitors over the holiday period. Prior to the holiday, growth in retail sales had been decelerating for months. China’s statistics agency reported a heavy year-on-year contraction for the consumer price index in January. Shen Meng, director at boutique investment bank Chanson & Co in Beijing said the holiday prompted many to open up their wallets. “People are also hoping the Year of the Dragon will bring a breakthrough for the economy,” Meng added.

Japan’s title as the world’s third-largest economy was relinquished to Germany after the country unexpectedly slipped into a recession at the end of last year. Japan’s gross domestic product (GDP) fell an annualized 0.4% in the fourth quarter of 2023 after a 3.3% slump in the third quarter, government data showed. Economists had forecasted a 1.4% increase. Economy minister Yoshitaka Shindo emphasized the importance of attaining solid wage growth to support consumption, which he described as “lacking momentum” due to increasing prices. “What’s particularly striking is the sluggishness in consumption and capital expenditure that are key pillars of domestic demand,” said Yoshiki Shinke, senior executive economist at Dai-ichi Life Research Institute. “The economy will continue to lack momentum for the time being with no key drivers of growth,” Shinke added. The definition of a technical recession is generally considered to be two consecutive quarters of contraction. “Two consecutive declines in GDP and three consecutive declines in domestic demand are bad news, even if revisions may change the final numbers at the margin,” said Stephan Angrick, senior economist at Moody’s Analytics.

Finally: The outlook for 2024 may seem brighter with GDP growth showing some resiliency and inflation on the decline, but we’re not quite out of the woods. Investors are crossing their fingers for some U.S. rate cuts by May, but the Fed’s not ready to pop the champagne just yet. Meanwhile, countries around the world are navigating a tricky economic landscape, dealing with everything from sudden inflation spikes to heavier debt loads and folks buckling down on discretionary spending. The visual below shows global GDP growth projections for this year, based on the International Monetary Fund (IMF) October 2023 Outlook and January 2024 update. The lowest growth is expected in Europe, forecasted at a mere 0.9%. Towards the end of 2023, Signa, a major European property firm worth billions, faced collapse due to the most significant increase in interest rates seen in the European Union’s 25-year history. Additionally, factors such as low consumer confidence and the repercussions of high energy costs are further dampening the economic outlook for this region. Over in Latin America, as domestic demand continued to advance and inflationary pressures eased, the IMF has upgraded its forecasts for Brazil and Mexico in 2024.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)