The very big picture (a historical perspective):

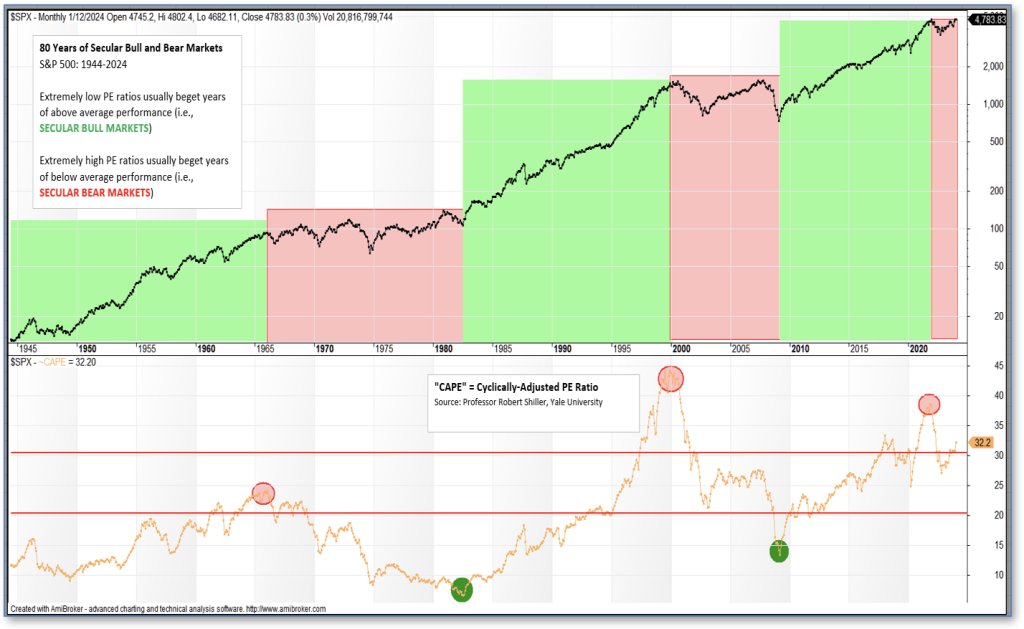

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”).

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 80-year view of Secular Bulls and Bears.

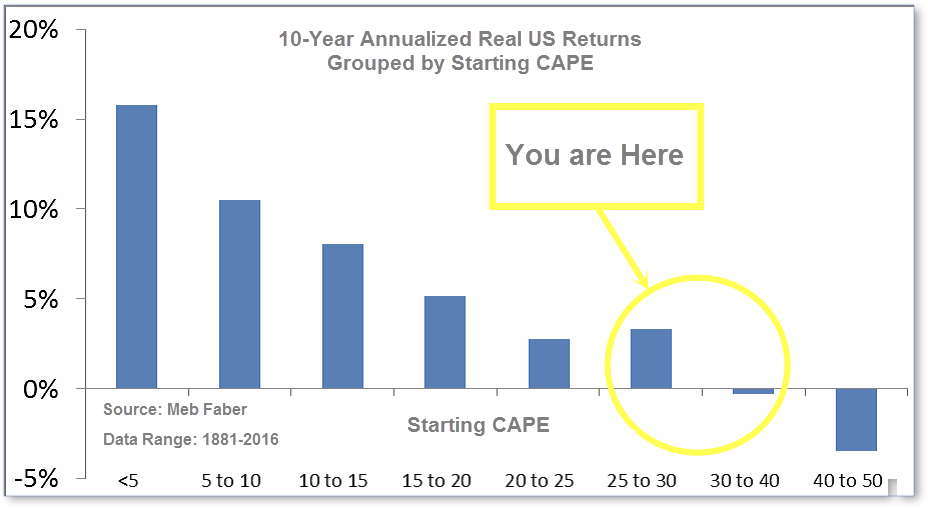

The CAPE is now at 33.83, up from the prior week’s 33.37. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our DELTA-V Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that all of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: The week started off quiet, but the market picked up momentum and small-cap stocks eventually found their footing. The Dow Jones Industrial Average was relatively unchanged as it moved from last week’s close of 38,654 to this week’s close of 38,672. The technology-heavy NASDAQ gained 2.3%. By market cap, the large cap S&P 500 rose by 1.4%, while the mid cap S&P 400 added 1.5%. The small cap Russell 2000 climbed 2.4%, closing at 2,010.

International Markets: The international indexes ended the week mixed. Canada’s TSX shed -0.4%, while the UK’s FTSE 100 fell -0.6%. France’s CAC 40 climbed 0.7%, whereas Germany’s DAX was relatively unchanged from last week’s close. In Asia, China’s Shanghai Composite advanced by 5.0%. Japan’s Nikkei added 2.0%. As grouped by Morgan Stanley Capital International, developed markets ticked up 0.2%, while emerging markets rose by 2.4%.

Commodities:The majority of precious metals declined by the end of the week. Gold ticked down -0.73% to $2,038.70 an ounce. Meanwhile, silver shed -0.89% to $22.59 an ounce. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, retreated -3.66%. West Texas Intermediate crude oil advanced 6.31% to $76.84 per barrel.

U.S. Economic News: The Institute for Supply Management’s survey climbed from 50.5% to 53.4% month-on-month. Economists predicted an ISM reading of 52.0%. Chairman of the survey Anthony Nieves said, “The majority of respondents indicate that business is steady. They are optimistic about the economy due to the potential impact of interest rate cuts.” There seemed to be an uptick in growth at the beginning of 2024, coinciding with the possibility of interest-rate cuts later in the year. The production gauge remained steady at 55.8%, suggesting a consistent level of output. Conversely, the new-orders index gained 2.2 points, reaching 55.0%, which could indicate underlying strength in demand for goods or services. Moreover, the employment barometer showed signs of recovery, climbing to 50.5% from a concerning low of 43.8% observed at the close of 2023. The prices-paid index, which serves as a gauge for inflation, surged by 7.3 points to 64.0%, marking its highest level in 14 months. Nieves said businesses “are cautious due to inflation, associated cost pressures and ongoing geopolitical conflicts.”

A report from the U.S. government showed a 0.4% increase in wholesale inventories for December, which added strength to the gross domestic product in the fourth quarter. Inventories represent goods manufactured for sale but have not actually been sold. Typically, businesses augment their inventories during periods of rising sales. The inventory-to-sales ratio remained unchanged at 1.34 months, which contrasted with the higher reading of 1.40 from the prior year. The ratio is a measure of the duration it would take a company to sell the goods sitting idly on warehouse shelves. The year-on-year decrease in readings suggests companies are experiencing a shorter period to sell their goods. Companies slightly curtailed production to mitigate the risk of being burdened with unwanted goods.

The number of Americans who applied for unemployment benefits this month decreased by 9,000 and settled at a total of 218,000, which underscored that the number of layoffs remained minimal. Tom Barkin, president of the Richmond Federal Reserve, said that the feedback he’s receiving from business contacts indicates a scenario of “not as much hiring, but not as much firing.” Meanwhile, the number of individuals collecting unemployment benefits in the U.S. decreased by 23,000 to 1.87 million. “The broad takeaway would appear to be that the pace of layoffs has not ticked up from last year,” said Stephen Stanley, chief economist at Santander Capital Markets.

In December, the U.S. trade deficit modestly increased; nevertheless, the annual gap reached its lowest point in three years, which contributed to the economy’s strong performance in 2023. Despite the 0.5% expansion of the trade gap to $62.2 billion in December, it remained respectively lower when compared to the same month year-on-year. Imports declined by 1.3% to $320.4 billion, the government said. Over the entire year, imports decreased by 3.6% from the peak of $3.65 trillion in 2022. The decrease in imports primarily reflected that the reduced cost of oil and diminished household demand for consumer goods such as cell phones and computers. Americans have been spending more on services such as travel and recreation. U.S. exports added 1.2% to a total of $258.2 billion, which also contributed to the economy. A weaker dollar and increasing U.S. oil shipments primarily strengthened exports last year. However, subdued global economic growth may exert negative pressure on exports in 2024. “Export growth is surely likely to moderate soon,” said deputy chief U.S. economist Andrew Hunter of Capital Economics.

Total U.S. consumer credit rose by $1.5 billion in December, which marked a decline from the $23.4 billion increase observed in the prior month, according to data from the Federal Reserve. Economists had anticipated a $15 billion increase in consumer credit for December. Revolving credit, such as credit cards, decelerated to a 1% growth rate after a 16.6% gain in the preceding month. Nonrevolving credit, such as student loans, ticked up 0.2% after the prior month’s 1.8% increase. The Federal Reserve’s data omits mortgage loans, which constitute the largest category of household debt. “For now, households aren’t drastically changing their debt trajectory when it comes to maintaining month-to-month spending on usual expenses. What we don’t know is at what point households feel they are no longer comfortable borrowing more money, and then they can’t maintain elevated spending,” said Will Compernolle, economist at FHN Financial.

International Economic News: Canada’s economy added 37,300 jobs last month. Despite this, wage growth slightly decelerated, according to recent data. Statistics Canada reported that the unemployment rate edged down from 5.8% to 5.7% in December, which was primarily attributed to a reduction in the number of individuals seeking employment. The participation rate decreased from 65.5% to 65.3% between December and January. Meanwhile, the average hourly wage growth for permanent employees eased to 5.3% last month. “The job market still seems resilient,” said Derek Holt, vice president of capital markets economics at Scotiabank. “We saw wage growth cool in the latest month, but overall, the trend is relatively hot,” Holt added.

Across the Atlantic, British services businesses seemed to have found solid footing at the outset of 2024, as a strong inflow of new orders and an accelerated hiring rate encouraged customers’ willingness to spend. The S&P Global services Purchasing Managers’ Index (PMI) for Britain rose from 53.4 to 54.3 between December and January, which exceeded an initial estimate of 53.8. “New orders have also rebounded this winter as receding recession risks and looser financial conditions led to greater willingness-to-spend among clients,” said Tim Moore, economics director at S&P Global Market Intelligence. The composite PMI increased from 52.1 in December to 52.9 in January as well, indicating the greater weight of the larger services sector. Meanwhile, the survey showed salaries remained a prominent driver in increasing costs, although overall costs were increasing at a relatively slow pace. “Softer cost inflation reflected lower energy and fuel costs, alongside falling raw material prices,” added Moore.

On Europe’s mainland, German industrial production declined further than anticipated in December, said federal statistical office Destatis. Industrial production fell by 1.6% month-on-month in December. Analysts had forecasted a 0.4% drop. Capital Economics’ senior Europe economist Franziska Palmas said the seventh straight monthly fall in German industrial output confirmed that industry has remained a significant drag on growth. “High energy costs and weak domestic and external demand will cause German industrial output to decline further in 2024,” said Palmas. The chemical industry experienced particularly strong declines. Meanwhile, production fell by 7.6% month-on-month. Construction declined by 3.4% and production fell in many other sectors, albeit less sharply, Destatis said. In contrast, the automotive industry had a 4.0% increase in production. “The sharp drop in both exports and imports, as well as today’s industrial production, not only illustrates the weakness of the German economy’s backbone but also increases the risk of a downward revision of fourth-quarter GDP growth,” said Carsten Brzeski, global head of macro at Internationale Nederlanden Groep (ING).

In France, the central bank said the French economy is on course to expand by 0.1% to 0.2% in the first quarter. “Declines in the construction and energy sectors were offset by a rise in value added in industry, while services remained stable”, the Bank of France said. The growth rate measured in the fourth quarter was updated from the prior 0.2% growth estimate to an essentially unchanged 0.0% rate. According to the Governor of the Banque de France, Francois Villeroy de Galhau, the central bank sees full-year growth at close to 0.9% this year. “Amid a general slowdown, the situations differ from sector to sector. Overall, services resist more than manufacturing,” Villeroy added. Meanwhile, the transport and automotive sectors were negatively impacted by the large-scale farmer protests that spread throughout France last month, the survey added. “But we don’t think that this crisis will significantly impact growth for the quarter and the year,” said Villeroy.

In Asia, China’s consumer price index fell 0.8% in January year-on-year, alongside producer prices, data from the National Bureau of Statistics (NBS) showed. Month-on-month, the CPI ticked up 0.3%. The annual CPI decline in January was primarily led by a sharp decrease in food prices. “The CPI data today shows China faces persistent deflationary pressure,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management. “China needs to take actions quickly and aggressively to avoid the risk of deflationary expectation to be entrenched among consumers,” Zhang added. Activity in China’s vast manufacturing sector contracted last month as well, according to an official survey. “Deflation/Disinflation is becoming entrenched,” said Carlos Casanova, senior Asia economist at Union Bancaire Privee in Hong Kong, in a note to clients. “The People’s Bank of China really ought to deliver stronger policy support,” Union Bancaire Privee’s Casanova added.

In Japan, Deputy Governor Shinichi Uchida said the Bank of Japan will likely end its risky asset purchases and avoid rapid rate hikes, while gradually reducing monetary support. “If sustainable and stable achievement of our 2% inflation target comes in sight, the large-scale monetary easing will have fulfilled its role, then we’ll explore whether it should be revised,” Uchida said. “If the BOJ (Bank of Japan) does revise the framework, it would incline more toward letting market forces determine interest rates… In doing so, however, it will take careful measures so as not to create discontinuity before and after the revision,” Uchida added. Toru Suehiro, chief economist at Daiwa Securities, said, “It sounds as if the BOJ is laying the groundwork for ending negative rates to minimize any market shock when it actually moves.”

Finally: Have you ever wondered which brands are the most valued worldwide? At the beginning of 2024, the world’s most valuable brand was Apple, valued at $517 billion, which marked a 73.6% increase year-on-year. Apple wasn’t the only American brand exhibiting strong demand. Six out of the top 10, and 51 out of the top 100, most valuable brands were from the United States. Brand Finance’s annual rankings for 2024 listed the most valuable brands by country in the visual below. The data used is related to the value of a specific brand, as opposed to general measures of value such as market cap. Outside of the U.S., South Korea’s Samsung took second place with a value of $99 billion. In recent years, Asian brands attained notable value worldwide. TikTok, originating from China (and its domestic equivalent, Douyin), became recognizable around the world and gained a value of $84 billion. Additionally, Japan’s Toyota and Saudi Arabia’s Saudi Aramco held brand values of $53 billion and $42 billion, respectively. In Europe, Germany’s Deutsche Telekom is Europe’s most valuable brand at $73 billion.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)