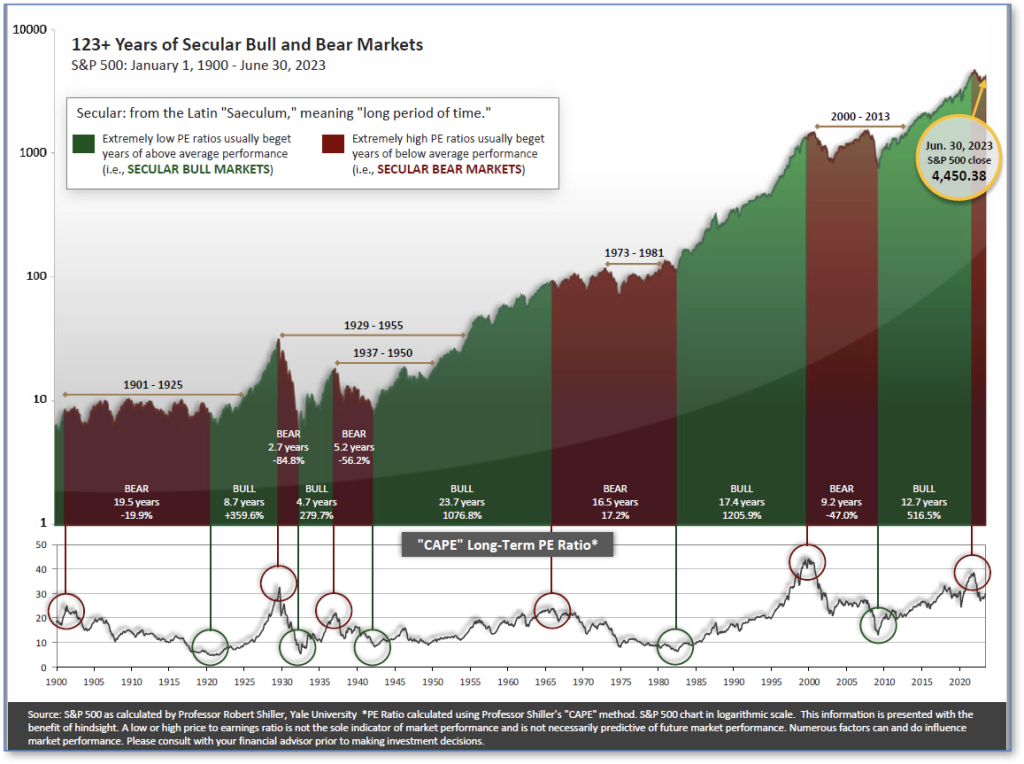

The very big picture (a historical perspective):

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears.

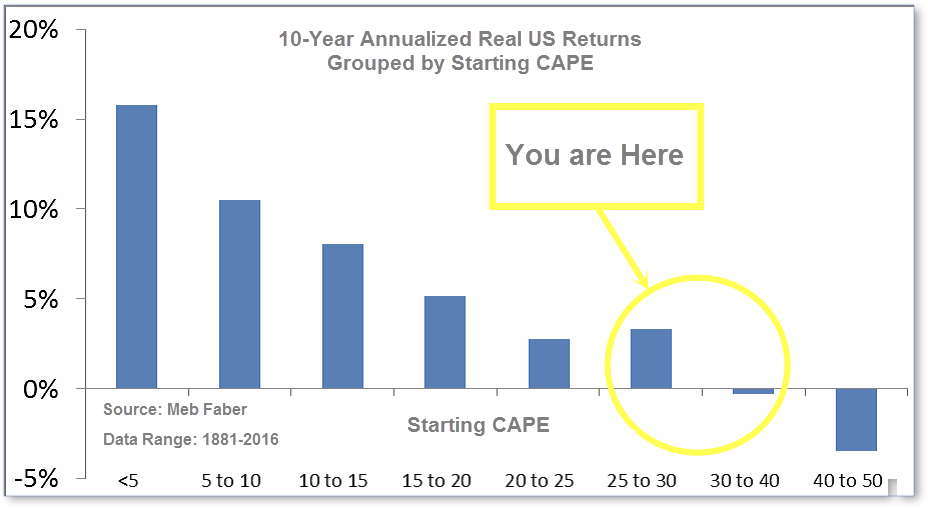

The CAPE is now at 31.15, up from the prior week’s 31.10. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: Helped by a late rally this week, the major indexes ended flat to slightly higher. The Dow Jones Industrial Average was essentially unchanged, closing the week at 36,248. The technology-heavy NASDAQ added 0.7%. By market cap, both the large cap S&P 500 and the mid cap S&P 400 ticked up by 0.2%. The small cap Russell 2000 finished the week up 1.0%.

International Markets: International indexes finished the week mixed. Canada’s TSX ticked down -0.6%, while the UK’s FTSE 100 rose 0.3%. France’s CAC 40 gained 2.5%, while Germany’s DAX climbed 2.2%. In Asia, China’s Shanghai Composite shed -2.0%. Japan’s Nikkei retreated -3.4%. As grouped by Morgan Stanley Capital International, developed markets ticked down -0.1%, while emerging markets lost -1.8%.

Commodities: Precious metals retreated this week. Gold decreased by -3.60% to $2,014.50 an ounce and Silver gave up -9.98% to $23.28. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, shed -2.57%. West Texas Intermediate crude oil pulled back for its seventh straight week giving up -3.83% to $71.23 per barrel.

U.S. Economic News: The services sector rebounded in November; ISM survey found. According to the Institute for Supply Management, a barometer of U.S. business conditions at service companies picked up to 52.7% last month. Economists had expected a reading of 52.4%. The index continued its 11-month streak of remaining above 50. Fifteen industries reported activity growth, whereas only three reported an activity decrease last month. New orders in the service sector were unchanged from October’s reading of 55.5%. Meanwhile, prices paid for inputs slipped from 58.6% to 58.3%. The ISM service employment index increased from 50.2 to 50.7. Anthony Nieves, head of the ISM services survey committee, said the buildup for this holiday season fell behind past years, but was nonetheless better than in 2022. “Employment growth in the U.S. economy has slowed consistently over the past year but remains solid. The ongoing need to hire workers across U.S. service industries is one factor that will keep the Fed’s monetary policy in ‘higher for longer’ mode,” said senior economist at PNC Financial Services, Kurt Rankin.

Job openings fell to 8.7 million in October. The Labor Department said job listings declined from a revised 9.4 million in September. The decreasing number of openings is perceived by the Federal Reserve as evidence that higher interest rates have slowed the economy and demand for labor. The parts of the economy where hiring had been its strongest, such as health care, finance, real estate, and retail, had the steepest drop in job openings. The number of job openings per unemployed worker slipped again to 1.3 from 1.5 in September. In October, 3.6 million people quit their jobs. The rate of people quitting their jobs among private-sector workers was unchanged at 2.6%. The U.S. economy added 150,000 new jobs in October. “This is a clear indication that the labor market continues to weaken and should confirm that no additional rate hikes will be announced at the December meeting,” said Eugenio Aleman, chief economist of Raymond James.

Jobless claims ticked up to 220,000, but layoffs remained low. The number of applicants for unemployment benefits last week was scarcely changed from a revised 219,000 to 220,000, the government said. Economists had forecasted new claims to total 222,000. While layoffs remained historically low, businesses have cut back on hiring. New jobless claims rose in 49 states and territories. The number of people collecting unemployment benefits fell by 64,000 to 1.86 million. In a note to clients, lead U.S. economist Nancy Vanden Houten of Oxford Economics wrote, “We think the claims data, along with other recent labor market statistics, are consistent with a job market that is cooling enough to rule out further rate hikes.”

The recent employment report showed 199,000 new jobs were created in November, while average hourly earnings increased 0.4%. However, the yearly increase in wages was unchanged at 4%. The public sector added 49,000 jobs last month. Meanwhile, most of the new jobs were added in the healthcare industry, which gained nearly 100,000. If government jobs are omitted, employment rose by 150,000. James Knightly, chief international economist of ING, said the report, “paints a picture of a cooling, but not collapsing job market and is therefore consistent with the soft-landing narrative.” Senior economist Jesse Wheeler of Morning Consult said, “While we’ve been seeing some cooling in recent months, job growth is still strong by historical standards.”

International Economic News: In Canada, the downturn in the service sector deepened last month as increased borrowing costs and consumer pessimism weighed on activity, S&P Global Canada services PMI data showed. In November, the headline business activity index fell from 46.6 to 44.5, which marked its sixth consecutive month of a reading below the 50 threshold. The S&P Global Canada Composite PMI Output Index, which elucidates manufacturing as well as service sector activity, fell from 46.7 to 44.8 in November. Data showed that Canada’s manufacturing PMI dropped to 47.7 last month. Paul Smith, economics director at S&P Global Market Intelligence, said in a statement, “Market conditions are soft, characterized by squeezed budgets and a degree of reticence amongst market participants to commit to new business given an uncertain economic outlook.” Smith said, “High interest rates were again reported as a factor depressing market activity, and there are some concerns that the economy could drop into recession in 2024.”

Across the Atlantic, the Bank of England said British businesses and households have coped with high interest rates so far, but the adjustment process is far from over. The Bank of England listed Geopolitical concerns with China and in the Middle East, alongside questions regarding the rise of artificial intelligence, in its half-yearly Financial Stability Report. British businesses had been broadly resilient to high rates and weak growth, “but the full impact of higher financing costs has not yet passed through to all borrowers,” the report said. “Rates are likely to need to remain at these levels for an extended period to bring inflation back to target on a sustained basis,” said Bank of England Governor Andrew Bailey. “The full effect of higher interest rates is yet to come through. Therefore, we remain vigilant to financial stability risks that might arise,” Bailey added.

German industrial orders unexpectedly declined by 3.7% in October, the federal statistical office Destatis said. Analysts had forecasted a rise of 0.2%. According to the data, after omitting large-scale orders, manufacturers saw a 0.7% rise in new orders at the start of the fourth quarter. The decline in incoming orders in the third quarter was sharper, at 4.6%, than in the second quarter of this year. Commerzbank economist Ralph Solveen said, “So far, many companies have compensated for the lower order intake by working off their order backlogs.” Solveen added, “In the long term, however, they will not be able to avoid reducing their production, which suggests that the German economy will continue to shrink in the winter months.”

Deputy Governor of the Banque de France,Agnès Bénassy-Quéré, said the central bank is not expecting a recession. According to the deputy governor, the property market is in a difficult position because interest rates have increased but prices have yet to fall. “As long as real estate prices haven’t adjusted, we’re in a bad spot,” Bénassy-Quéré said. “What is probable is that interest rates stabilize,” she added. French companies have an advantage in terms of corporate borrowing compared with those in other European companies, which have borrowed at fixed rates over longer periods, the deputy governor said. About 53% of them will have to refinance debt by the end of 2025. “We don’t have specific worries,”Bénassy-Quéré said. “We’re not anticipating a recession in France. The central scenario is that it’s really a soft landing of the global and European economies,”Bénassy-Quéré added.

In China, consumer prices fell in November, but factory-gate deflation persisted. The consumer price index (CPI) retreated 0.5% last month both from a year earlier and compared to October’s reading, data from the National Bureau of Statistics (NBS) showed. Analysts had expected the CPI to drop 0.1%. The producer price index (PPI) fell 3.0% year-on-year, which marked the fourteenth straight month of decline. Economists had forecasted a 2.8% fall last month. NBS statistician Dong Lijuan said, “The decrease in CPI in November was mainly attributed to factors including downward fluctuations in food and energy prices. Core CPI remained stable during the month.”

Japan’s economy fell more than expected in the third quarter, according to revised data from the Cabinet Office. The economy lost an annualized 2.9% between July and September. The previous estimate was a 2.1% contraction. Consumer and business spending simultaneously shrank, which weakened gross domestic product (GDP) in the third quarter. Real wages and household spending continued to fall in October, as ongoing inflation discouraged consumers. While nominal salaries rose 1.5%, inflation over 3% cancelled out the wage growth in real terms, which is viewed as a gauge of consumers’ purchasing power. With stagnant income, household spending decreased 2.5% in October year-on-year, and fell for the eighth consecutive month, according to data from the internal affairs ministry. “Weakness in personal consumption is likely to continue for the foreseeable future, as real disposable income is likely to extend its decline, which is seen as a factor in sluggish consumption,” said Kota Suzuki, an economist at Daiwa Securities.

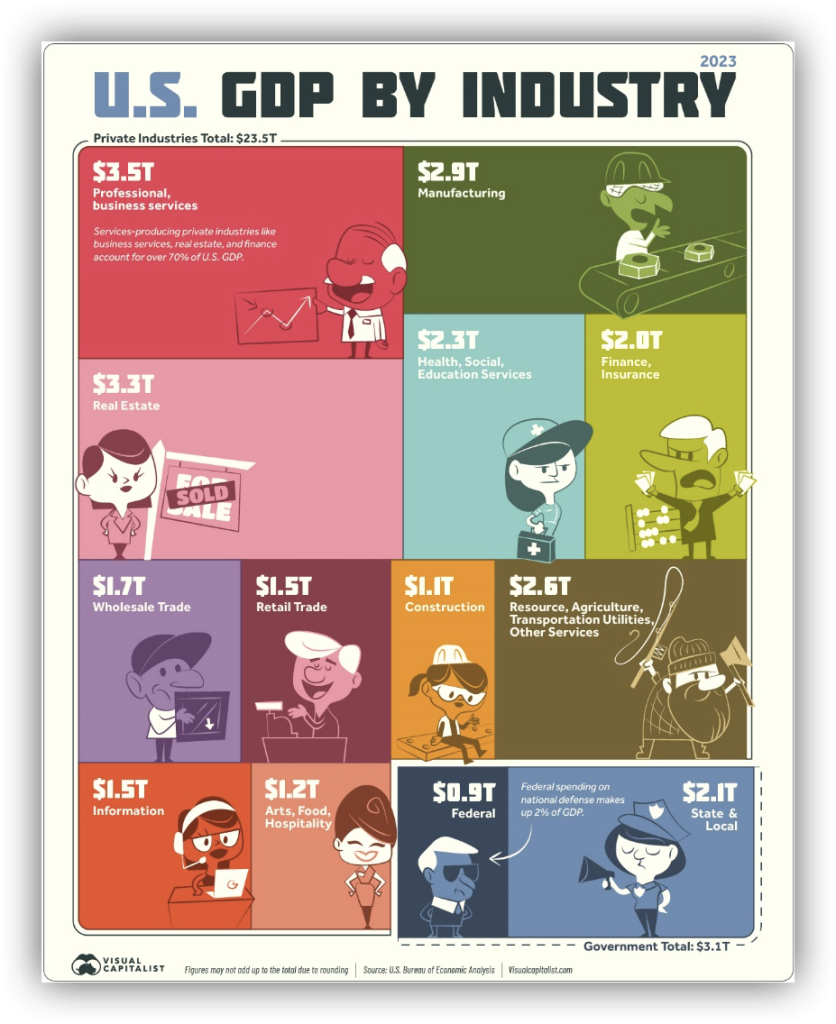

Finally: Understanding the breakdown of national gross domestic product (GDP) by industry shows where commercial activity is robust and how diverse the economy really is. Here’s what U.S. GDP for 2023 looks like when broken down by industry. According to data from the Bureau of Economic Analysis, in the first quarter of 2023, the annualized GDP of the U.S. was $26.5 trillion. Of this, 88% was derived from private industries. The remaining came from government spending at the federal, state, and local levels. Service-based industries, such as professional and business services, real estate, finance, and health care, provided the bulk of U.S. GDP at 70%. Professional and business services is the largest industry with $3.5 trillion in value added. Over the next decade, services-producing industries are projected to see the fastest growth in output. The five fastest-growing industries in the U.S. from 2022-2032, based on data from the Bureau of Labor Statistics, are software publishers at 5.2%, computing infrastructure providers at 3.9%, wireless telecommunications carriers (excluding satellite) at 3.6%, home health care services at 3.6% as well, and oil and gas extraction at 3.5%.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)