THE COMPLETE PICTURE

>> Four indicators across three time frames.

>> When the Sherman Portfolios indicators are positive status, we read the market as being in a Bull Market.

1. DELTA-V — Positive since June 27, 2025

2. GALACTIC SHIELD — Positive since April 1, 2023

3. STARFLUX — Positive since May 12, 2025

4. STARPATH — Positive since May 14, 2025

The shorter term picture:

>> GALACTIC SHIELD — POSITIVE for Q2 2025,, This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter.

>> STARFLUX — POSITIVE,, Starflux ended the week at 10.54 (Down 8.51% last week) This short-term indicator measures U.S. Equities.

>> STARPATH — POSITIVE, This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The big picture:

The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate.

>> The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in a Bull status at 60.63, up 2.29% from the prior week’s 59.27. It has signaled Bull since June 27, 2025.

>> The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 60.00, up 1.85% from the prior week’s 58.91. It has signaled Bull since December 15, 2023.

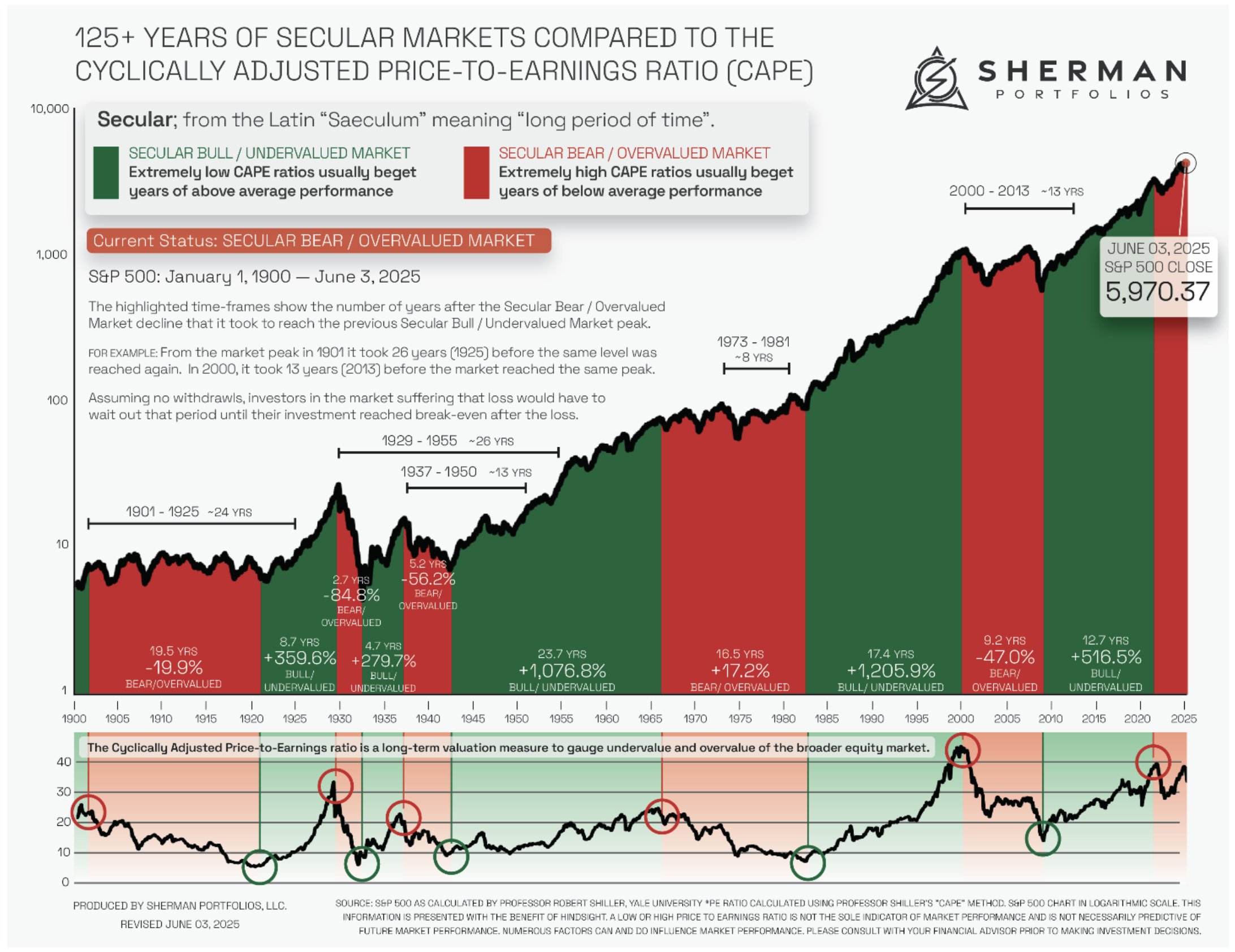

The very big picture (a historical perspective): The CAPE is now at 38.12.

The cyclically adjusted price-to-earnings ratio (CAPE) can be used to smooth out the shorter-term earnings swings to get a longer-term assessment of market valuation. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value.

In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30. The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum.

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum.

THIS WEEK IN THE MARKETS

U.S. Markets:

Stocks decline over renewed tariff concerns:

U.S. stock indexes ended the week modestly lower, though the tech-focused Nasdaq Composite Index held up best among the major benchmarks. While tariff news dominated headlines, market reaction was more subdued than in past episodes, with little performance difference between large- and small-cap stocks, and growth stocks faring slightly better than value. Investors looked to airline earnings as a gauge of consumer strength, with Delta Air Lines offering a supportive full-year 2025 outlook—its first since withdrawing guidance after early-April tariff news—and reporting a rebound in travel demand, which broadly boosted airline stocks. Meanwhile, NVIDIA reached a $4 trillion market capitalization for the first time, reinforcing its place among the “Magnificent Seven” mega-cap stocks.

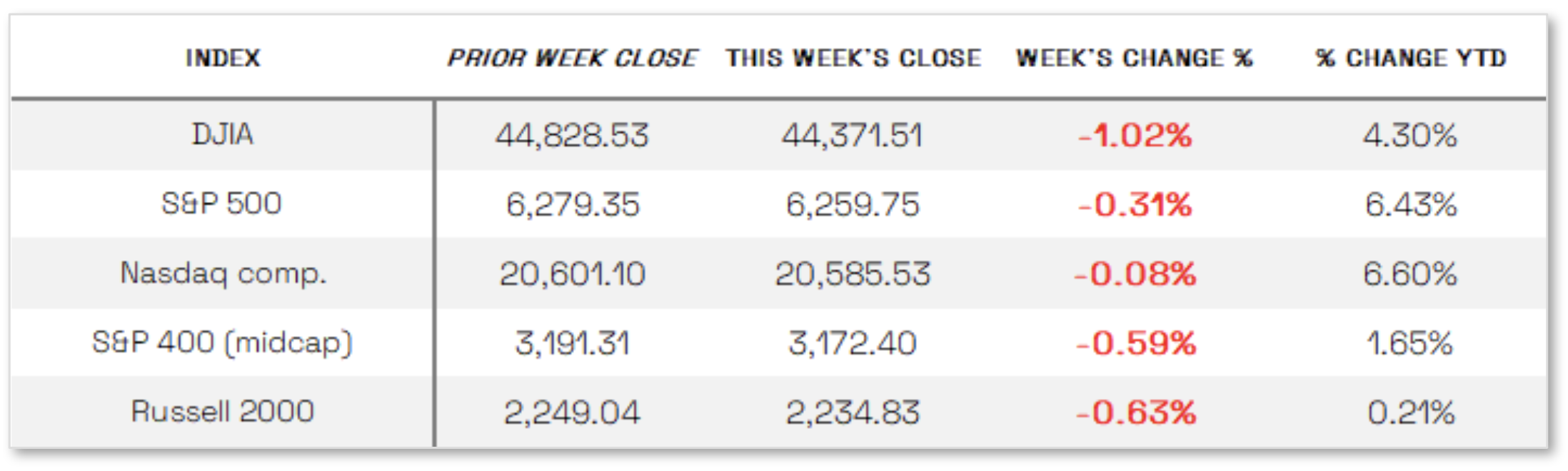

Looking at the US Indexes:

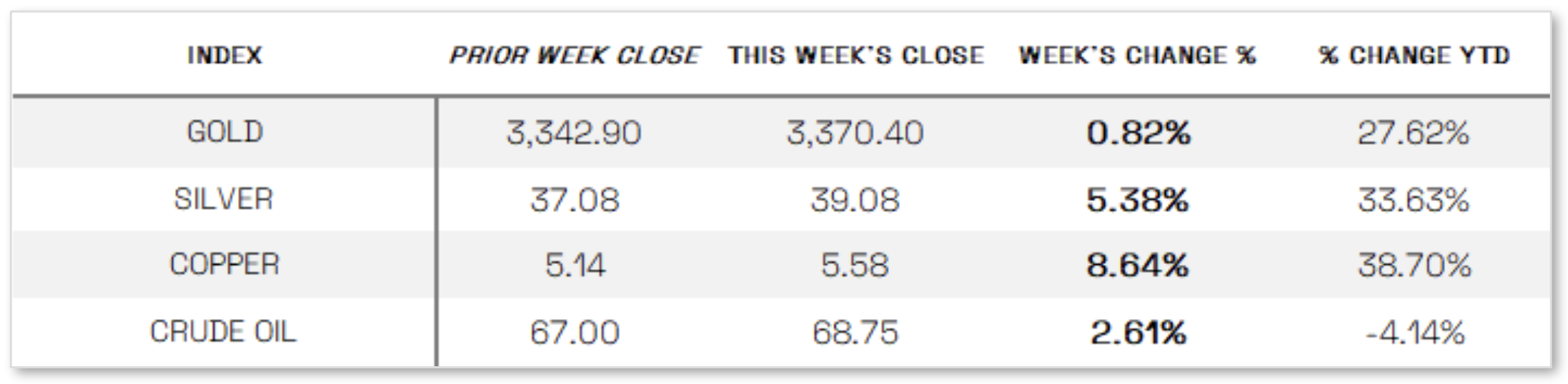

U.S. Commodities/Futures:

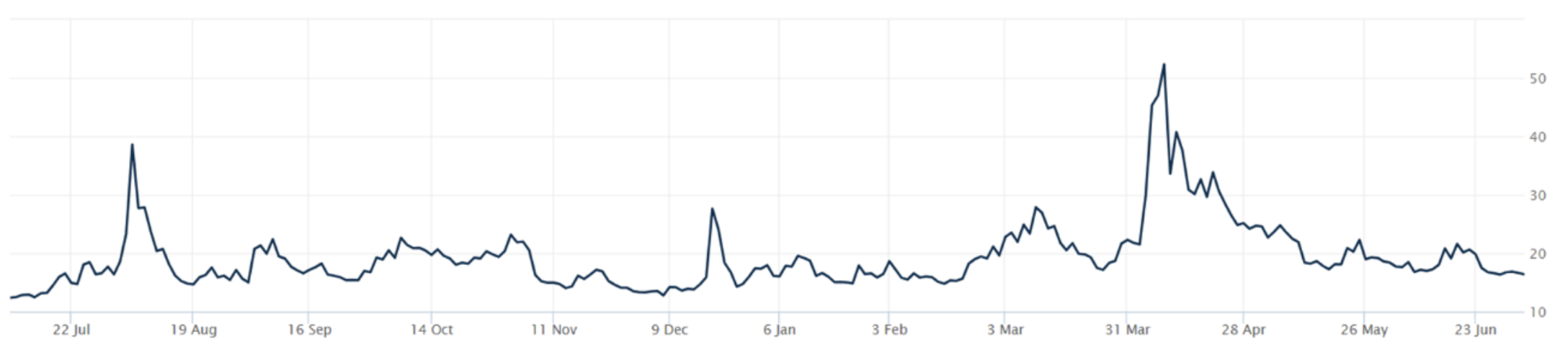

THE VOLATILITY INDEX (VIX) closed at 16.40 this week, a 0.1% increase vs last week’s close of 16.38.

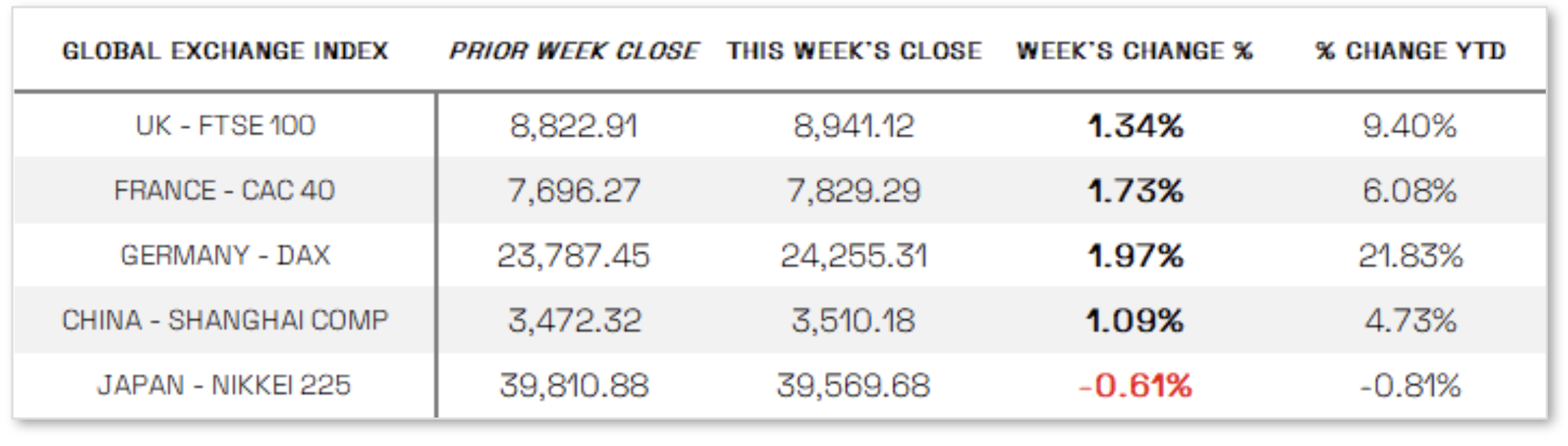

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News:

Tariffs and uncertainty on Fed Rates: President Trump announced a new round of tariffs, including 25% levies on key trading partners South Korea and Japan, along with varying rates on other countries such as Canada, South Africa, Thailand, and Malaysia. A sharp 50% tariff on Brazilian imports was also introduced, linked to the country’s legal actions against former President Jair Bolsonaro. In addition to the country-specific measures, Trump revealed a forthcoming 50% tariff on copper, prompting a sharp rise in U.S. copper futures, while international copper benchmarks remained flat or declined slightly. Meanwhile, the Federal Reserve’s mid-June meeting minutes revealed divisions among policymakers regarding the path of interest rates; while most foresee rate cuts this year—with two open to reductions as early as July—some members expect no cuts at all through 2025. Markets showed little reaction to the release.

International Economic News:

EUROPE: The pan-European STOXX Europe 600 Index rose 1.15% in local currency terms, buoyed by optimism over potential new trade deals between the U.S. and other countries, though gains were trimmed late in the week after President Trump announced plans to notify the EU of higher tariffs. Major European indexes also advanced, with France’s CAC 40 up 1.73%, Germany’s DAX gaining 1.97%, Italy’s FTSE MIB adding 1.15%, and the UK’s FTSE 100 climbing 1.34% and reaching a record high. In the UK, economic data disappointed as GDP contracted by 0.1% in May—following a 0.3% decline in April—driven by weakness in production and construction, despite expectations for a modest rebound. Over the past three months, GDP still showed 0.5% growth. Meanwhile, the housing market showed signs of stabilization, with Halifax reporting flat prices in May after a 0.3% decline in April and a 2.5% year-over-year increase. Buyer activity picked up, and reports indicated that Finance Minister Rachel Reeves may introduce a permanent mortgage guarantee scheme to support first-time buyers.

JAPAN: Japanese stock markets declined over the week, with the Nikkei 225 falling 0.61% and the broader TOPIX down 0.17%, as investor sentiment was dampened by renewed tariff tensions with the U.S. and mixed domestic economic data. The U.S. announced a modest increase in tariffs on Japanese imports to 25%, up from 24%, though markets took some comfort in the delayed implementation date of August 1, 2025, which leaves room for further negotiations. The yen weakened slightly to around JPY 146.8 per U.S. dollar, compared to JPY 146.0 the previous week, while the yield on the 10-year Japanese government bond edged up to 1.49% from 1.45%. Political uncertainty also weighed on markets ahead of Japan’s July 20 Upper House election, where Prime Minister Shigeru Ishiba’s ruling coalition is expected to lose seats.

CHINA: Mainland Chinese stock markets advanced as persistent deflation data fueled expectations of further stimulus, with the CSI 300 Index rising 0.82% and the Shanghai Composite gaining 1.09% in local currency terms, according to FactSet, while Hong Kong’s Hang Seng Index edged up 0.93%. The producer price index fell 3.6% in June from a year earlier—marking the 33rd straight month of factory-gate deflation and the steepest decline in nearly two years—while the consumer price index unexpectedly rose 0.1%, breaking a four-month streak of declines. Analysts attributed the slight CPI increase to recent stimulus efforts rather than a genuine rebound in consumer confidence. The inflation data reinforced speculation that Chinese authorities may introduce additional policy support to combat the prolonged cycle of falling prices, wages, and corporate profits. Earlier in July, at a high-level economic meeting led by President Xi Jinping, officials emphasized the need to address deflation by cracking down on “disorderly” low-price competition and phasing out outdated industrial capacity, highlighting the urgency of reviving domestic demand.

Sources:

>> All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal.

>> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute.

>> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update.html

Disclosures: This material and any mention of specific investments is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.