The very big picture (a historical perspective): The CAPE is now at 38.29.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30.

The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

HISTORY OF THE CAPE VALUE FROM 1871 TO PRESENT

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum. https://www.multpl.com/shiller-pe

The big picture: The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate. The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BULL status at 71.63, up 1.17% from the prior week’s 70.80. It has signaled Bull since April 21, 2023. The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 53.23, up 3.44% from the prior week’s 51.46. It has signaled Bull since December 15, 2023.

The shorter term picture: GALACTIC SHIELD — POSITIVE for Q4 2024, indicating positive prospects for equities in the fourth quarter of 2024. This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter. STARFLUX— POSITIVE, ended the week at 7.76 (up 2.78% last week) This short-term indicator measures U.S. Equities. STARPATH — POSITIVE, This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The complete picture (four indicators across three timeframes): When all four of the Sherman Portfolios indicators are in a POSITIVE status, we read the market as being in a BULL MARKET.

1. DELTA-V — Positive

2. GALACTIC SHIELD — Positive

3. STARFLUX— Positive

4. STARPATH — Positive

THIS WEEK IN THE MARKETS

U.S. Markets: Stocks up in short week: Stocks continued their upward momentum last week, with the Dow Jones Industrial Average, S&P 500, and S&P 400 MidCap Index reaching record intraday highs, joined by the small-cap Russell 2000 Index, which climbed to a new peak of 2,466.49 on Monday, surpassing its previous record set over three years ago. Trading activity remained robust ahead of the Thanksgiving holiday, during which markets were closed on Thursday and operated for a shortened session on Friday. Investor sentiment appeared influenced by domestic policy developments, notably President-elect Donald Trump’s nomination of hedge fund veteran Scott Bessent as Treasury secretary, a move welcomed by markets due to his perceived focus on economic stability, inflation control, and a measured tariff approach.

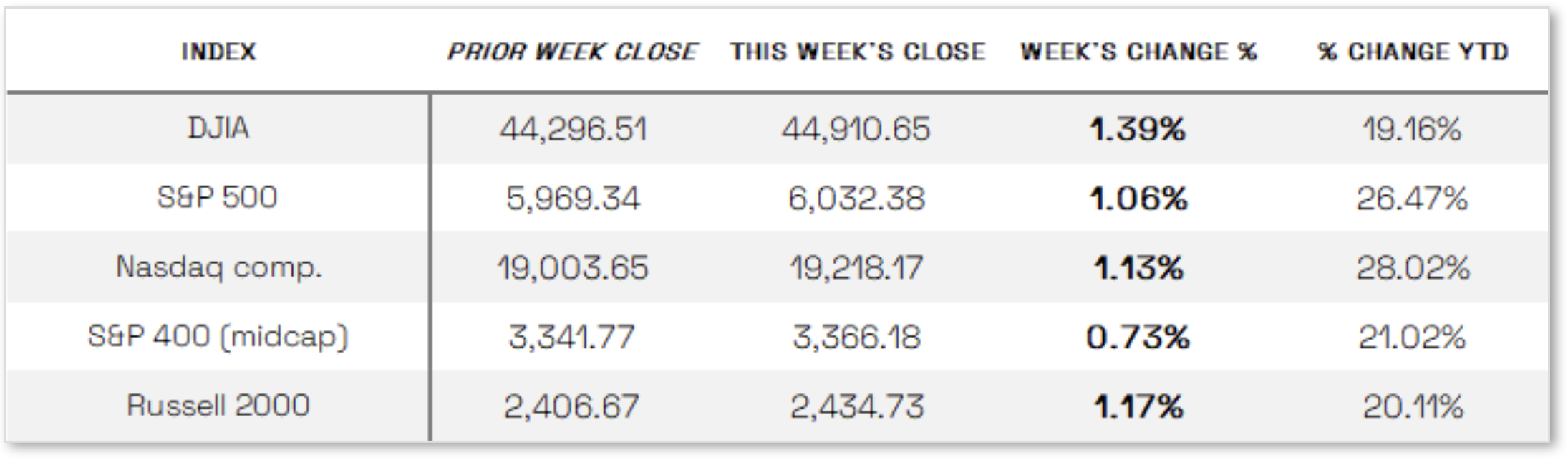

Looking at the US Indexes:

The Dow Jones Industrial Average (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft). The Dow ended the week up 1.39% at 44,910.65 vs the prior week of 44,296.51.

The Nasdaq Composite Index tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks. The tech-driven Nasdaq ended the week up 1.13%, closing at 19,218.17 vs. the prior week of 19,003.65

The S&P 500 large-cap index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall. The S&P 500 ended the week up 1.06%, closing at 6,032.38 compared to last week’s 5,969.34.

The S&P 400 mid-cap index is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks. The S&P 400 mid-cap ended the week up 0.73%, closing at 3,366.18 compared to last week’s 3,341.77.

The Russell 2000 (RUT) small-cap index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Russel 2000 ended the week up 1.17%, closing at 2,434.73 compared to last week’s 2,406.67.

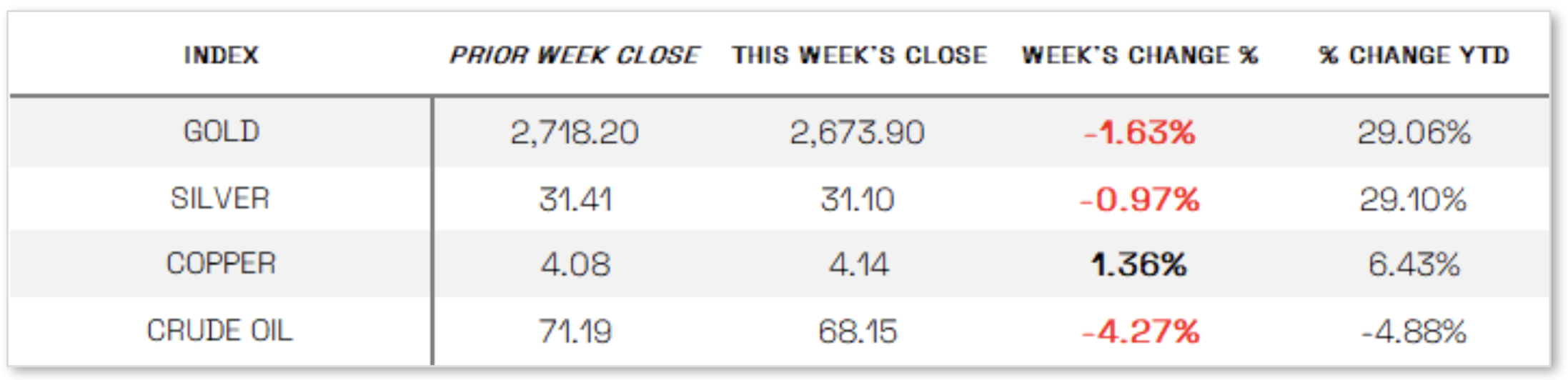

U.S. Commodities/Futures:

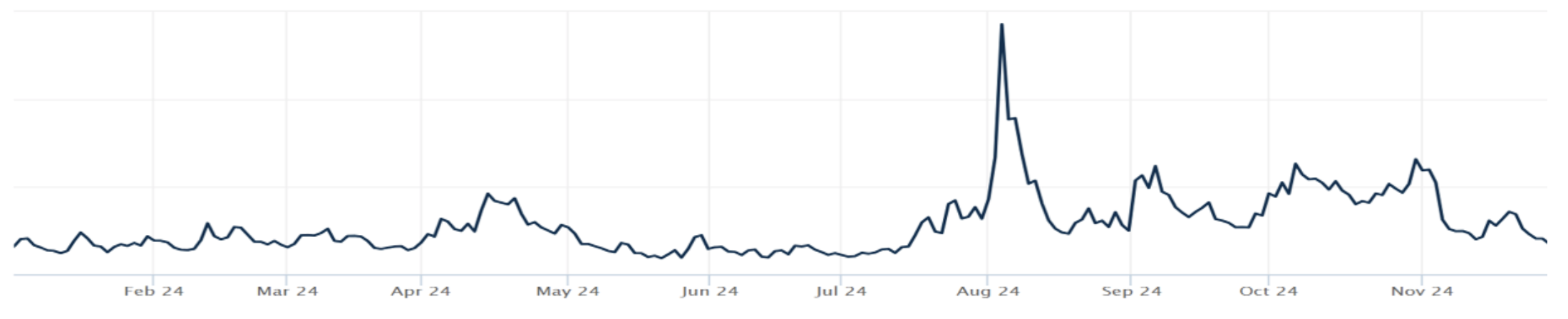

THE VOLATILITY INDEX (VIX) closed at 13.51 this week, an 11.4% decrease vs last week’s close of 15.24.

International Markets:

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News: Mixed Economic data: Mixed economic data:President-elect Trump’s announcement of plans to impose 25% tariffs on imports from Mexico and Canada and an additional 10% tariff on Chinese imports rattled automakers, with shares of Ford and General Motors (GM) plunging sharply on Tuesday—GM fell 8.99%—due to concerns over their reliance on cross-border trade with Canada and Mexico for parts and assembly. Despite this, the broader market remained resilient, as the S&P 500 extended its winning streak to seven sessions, its longest in over two months. Market sentiment was bolstered by news of a cease-fire agreement between Israel and Hezbollah, though energy stocks declined as oil prices retreated on reduced fears of wider conflict involving Iran. High trading volumes were further supported by a slew of economic data released midweek, including stronger-than-expected personal income and spending growth in October, as well as a surprising 2.0% rise in pending home sales. However, the manufacturing sector showed continued weakness, with durable goods orders missing expectations at 0.2% growth and core capital investment falling 0.2%.

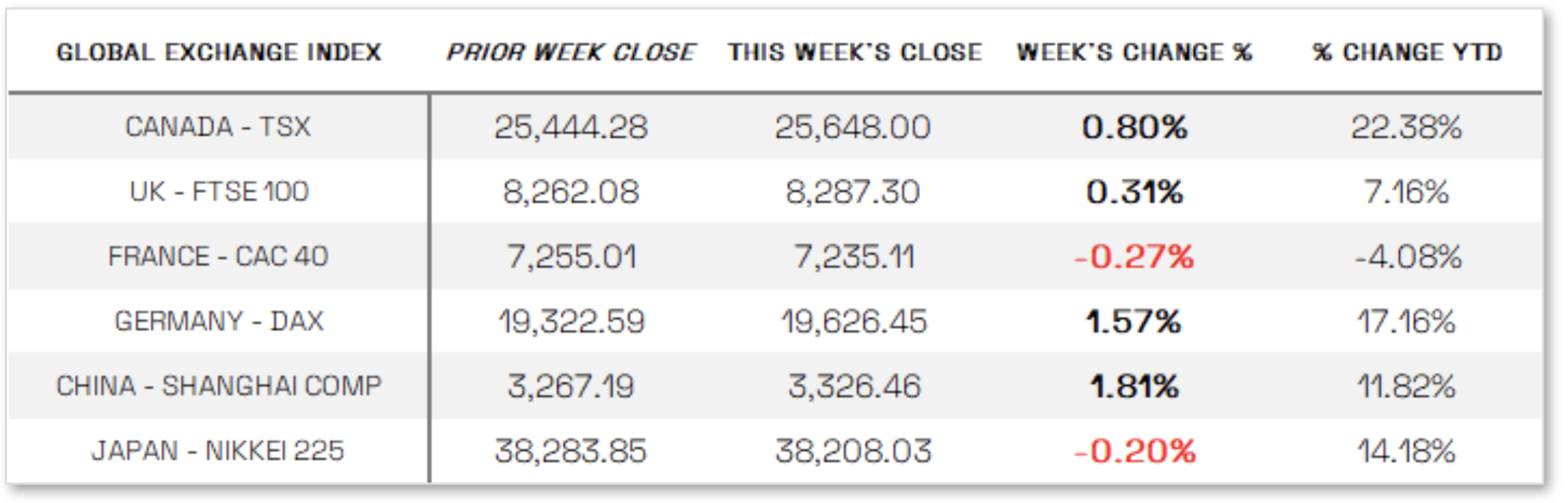

International Economic News: EUROPE: The pan-European STOXX Europe 600 Index edged up 0.32% in local currency terms, shrugging off concerns about U.S. trade tariffs and interest rate uncertainty, while major regional indexes delivered mixed results. Germany’s DAX climbed 1.57%, the UK’s FTSE 100 rose 0.31%, but France’s CAC 40 declined 0.27%, respectively. In the eurozone, annual inflation rose to 2.3% in November from 2.0% in October, driven by base effects from last year’s lower energy prices, though core inflation remained steady at 2.7%, and services inflation ticked down slightly. Despite signs of easing underlying price pressures, markets anticipate a European Central Bank rate cut next month, though its scale remains uncertain. Meanwhile, German economic data revealed ongoing struggles, with retail sales dropping 1.5% in October, far worse than the forecasted 0.5% decline. However, the labor market displayed resilience, as unemployment rose by only 7,000 in November—well below expectations—keeping the jobless rate steady at 6.1%.

JAPAN: Japan’s stock markets recorded modest declines, with the Nikkei 225 slipping 0.2% and the broader TOPIX falling 0.6%, as geopolitical risks dampened global investor risk appetite and bolstered demand for safe-haven assets. The resulting yen appreciation, which strengthened to around JPY 150 per USD from the JPY 154 range the prior week, created challenges for Japan’s export-heavy industries. The yen’s gains were also fueled by hotter-than-expected inflation data, with the Tokyo-area core CPI rising 2.2% year over year in November, up from 1.8% in October, sparking speculation about the Bank of Japan’s potential rate hike timing, likely in December or January. Meanwhile, the yield on the 10-year Japanese government bond edged down to 1.06% from 1.08% but remained near a 13-year high amid anticipation of tighter monetary policy, as BoJ Governor Kazuo Ueda emphasized that rate hikes depend on economic and inflation trends meeting the bank’s forecasts.

CHINA: Chinese equities advanced as optimism over potential government support outweighed concerns about possible U.S. tariff hikes. The Shanghai Composite Index rose 1.81%, the blue-chip CSI 300 gained 1.32%, and Hong Kong’s Hang Seng Index climbed 1.01%, according to FactSet. The People’s Bank of China injected RMB 900 billion into the banking system through its medium-term lending facility, maintaining the lending rate at 2%, as expected. However, with RMB 1.45 trillion in loans expiring next month, November saw a net liquidity withdrawal of RMB 550 billion. Liquidity pressures are expected to intensify as local government bond issuance rises toward year-end, prompting analysts to predict further economic support measures in 2025. Meanwhile, industrial profits fell 10% year over year in October, narrowing from September’s 27.1% drop, marking the third consecutive monthly decline. The slowdown in profit contraction reflected government support measures and growth in equipment and high-tech manufacturing sectors, according to the National Bureau of Statistics.

Sources: All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal. >> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. >> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update

Disclosures: This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. Past performance cannot guarantee future results.