THE COMPLETE PICTURE

>> Four indicators across three time frames.

>> When the Sherman Portfolios indicators are not all the same status, we read the market as being in a Mixed Market.

1. DELTA-V — Negative since April 4, 2025

2. GALACTIC SHIELD — Positive since April 1, 2023

3. STARFLUX— Positive since May 12, 2025

4. STARPATH — Positive since May 14, 2025

The shorter term picture:

>> GALACTIC SHIELD — POSITIVE, for Q2 2025, This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter.

>> STARFLUX — POSITIVE, Starflux ended the week at 13.73 (up 13.73% last week) This short-term indicator measures U.S. Equities.

>> STARPATH — POSITIVE, This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The big picture:

The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate.

>> The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BEAR status at 51.35, up 1.99% from the prior week’s 50.35. It has signaled Bear since April 4, 2025.

>> The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 53.07, up 0.91% from the prior week’s 52.59. It has signaled Bull since December 15, 2023.

THIS WEEK IN THE MARKETS

U.S. Markets:

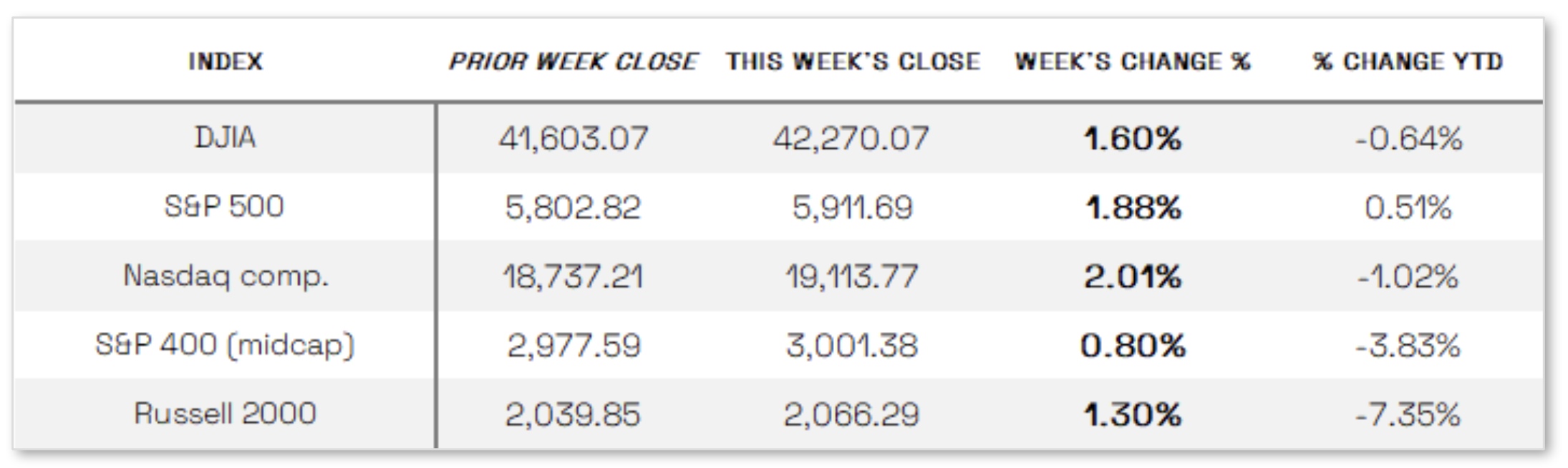

Stocks up this week:

U.S. stocks closed higher in a holiday-shortened week, driven largely by trade policy developments, although markets pulled back from their peak levels by week’s end. The Nasdaq Composite led gains with a 2.01% increase, followed by the S&P 500 at 1.88% and the Dow Jones Industrial Average at 1.60%, while smaller-cap indexes also posted modest gains. Investor sentiment was initially buoyed by President Trump’s announcement delaying a new 50% tariff on European Union imports until July 9 and fast-tracking negotiations, prompting a strong start to the week. Optimism grew further after the U.S. Court of International Trade ruled that Trump lacked the authority to impose most global tariffs enacted since the start of his second term, sparking a market rally on Thursday morning. However, the administration’s swift appeal and a federal court’s temporary hold on the ruling reversed some of those gains by week’s end. Sentiment was further weighed down by Treasury Secretary Scott Bessent’s comments that U.S.-China trade talks had stalled and President Trump’s unverified social media claims that China had violated its preliminary trade agreement with the U.S.

Looking at the US Indexes:

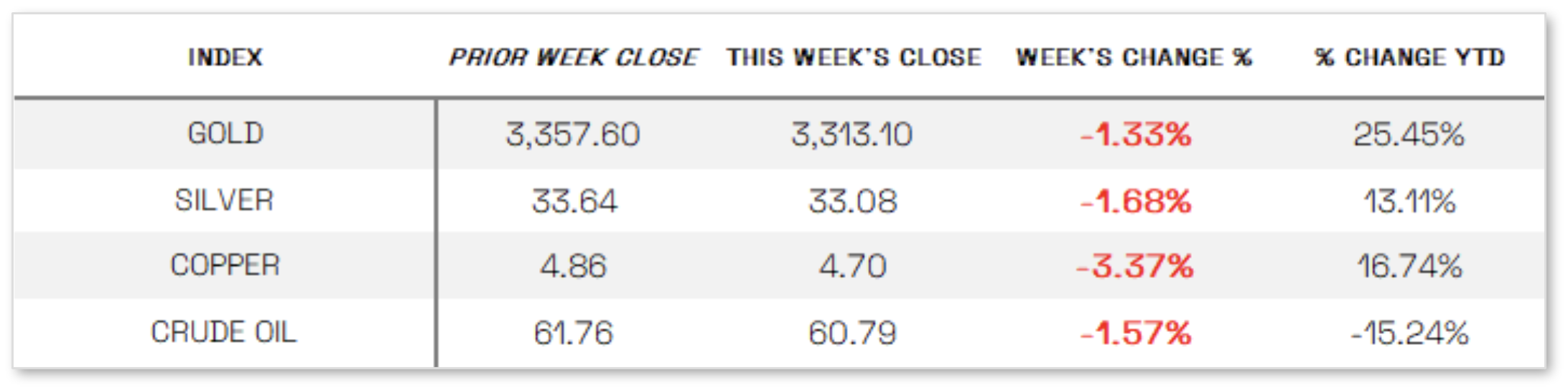

U.S. Commodities/Futures:

THE VOLATILITY INDEX (VIX) closed at 18.57 this week, a 16.7% decrease vs last week’s close of 22.29.

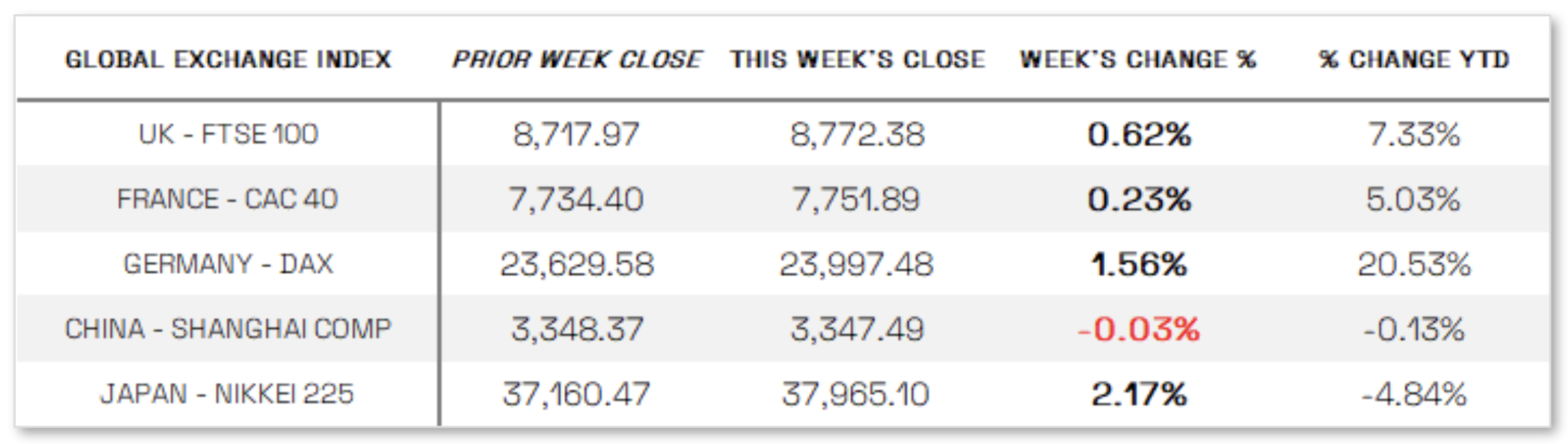

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News:

Positive outlook in economic Data: Inflation showed signs of easing as the Bureau of Economic Analysis reported that the core personal consumption expenditures (PCE) index—considered the Federal Reserve’s preferred inflation gauge—rose 2.5% year over year in April, down from 2.7% in March and marking the slowest annual pace since 2021. Despite this encouraging trend, inflation remains above the Fed’s 2% target, and markets anticipate the full effects of tariffs will emerge later this summer. According to minutes from the Fed’s May 6–7 meeting, policymakers still view inflation risks as tilted to the upside, citing ongoing uncertainty around trade and other economic policies. On the consumer side, confidence rebounded in May, with The Conference Board’s Consumer Confidence Index rising sharply by 12.3 points to 98, ending a five-month decline, driven largely by improved expectations and momentum following the May 12 U.S.-China trade deal. Similarly, the University of Michigan’s final reading of its May Index of Consumer Sentiment held steady after months of decline, with sentiment improving notably in the second half of the month as tariff tensions temporarily eased—highlighting that trade policy remains a key influence on consumer outlook, even as inflation expectations stayed elevated.

International Economic News:

EUROPE: The pan-European STOXX Europe 600 Index rose 0.65% in local currency terms after U.S. President Trump extended the deadline for 50% tariffs on the European Union, allowing more time for trade negotiations, while slowing inflation in key European economies bolstered expectations of a European Central Bank rate cut. Germany’s DAX climbed 1.56%, Italy’s FTSE MIB gained 1.55%, France’s CAC 40 added 0.23%, and the UK’s FTSE 100 rose 0.62%. However, economic data painted a mixed picture, as Germany saw its number of unemployed rise by 34,000 in May—more than triple analyst forecasts—bringing the total to 2.96 million, near the psychologically significant 3 million mark, with job openings falling 67,000 year over year to 634,000, signaling softening labor demand. In the UK, business confidence in the services sector dropped to a two-and-a-half-year low during the three months through May, impacted by a rise in employment taxes and growing price expectations, according to the Confederation of British Industry. Investment plans, hiring, and business volumes also declined, while vehicle production in April fell 15.8% from a year earlier to 59,203 units, the lowest April level since 1952, excluding the pandemic period, as reported by the Society of Motor Manufacturers and Traders.

JAPAN: Japan’s stock markets rebounded over the week, with the Nikkei 225 rising 2.17% and the broader TOPIX Index gaining 2.41%, driven by optimism over a potential U.S.-Japan trade agreement following a reportedly constructive call between Prime Minister Shigeru Ishiba and President Donald Trump ahead of their fourth round of talks in Washington. Speculation about a deal by the G7 summit in mid-June was further fueled by Trump’s support for Nippon Steel’s bid for U.S. Steel. Meanwhile, the yield on the 10-year Japanese government bond (JGB) fell to around 1.51% from 1.55%, reflecting increased demand for safe-haven assets amid renewed trade tensions and the reinstatement of Trump’s “reciprocal” tariffs, with JGB yields tracking declines in U.S. Treasuries. Stronger-than-expected Tokyo core inflation data added to hopes of a future interest rate hike, although Bank of Japan Governor Kazuo Ueda maintained the central bank’s cautious stance, citing risks to global growth, moderating cost-push inflation, and falling oil prices as reasons for a recent downward revision to the inflation outlook. He emphasized that the BoJ’s near-term policy would remain unchanged but flexible in pursuit of its 2% inflation target. The yen also strengthened, surpassing JPY 144 against the U.S. dollar, supported by the firm inflation data and the reversal of an earlier tariff ruling.

CHINA: Mainland Chinese stock markets declined over the week amid a light economic calendar and subdued investor sentiment following a temporary pause in the U.S.-China trade war, with the CSI 300 Index falling 1.08% and the Shanghai Composite Index edging down 0.03% in local currency terms, while Hong Kong’s Hang Seng Index dropped 1.32%, according to FactSet. In response to the ongoing uncertainty and ahead of the expiration of the 90-day negotiation window in August, Beijing has intensified efforts to support its economy, reportedly planning to allocate RMB 500 billion (approximately USD 70 billion) for investment in new infrastructure through a financing tool involving three state-run policy banks, targeting areas like artificial intelligence, the digital economy, and consumer-related infrastructure. Meanwhile, Chinese officials are working on the country’s next Five-Year Plan, starting in 2026, and are reportedly considering maintaining the manufacturing sector’s share of GDP at a stable level over the long term—a signal that Beijing remains committed to its industrial-led growth strategy, despite criticism from the U.S. and Europe over trade imbalances it may exacerbate.

Sources:

>> All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal.

>> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute.

>> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update.html

Disclosures: This material and any mention of specific investments is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.