THE COMPLETE PICTURE

>> Four indicators across three time frames.

>> When the Sherman Portfolios indicators are not all the same status, we read the market as being in a Mixed Market.

1. DELTA-V — Negative since April 4, 2025

2. GALACTIC SHIELD — Positive since April 1, 2023

3. STARFLUX— Negative since March 10, 2025

4. STARPATH — Negative since March 7, 2025

The shorter term picture:

>> GALACTIC SHIELD — POSITIVE, for Q2 2025, This indicator is based on the combination of U.S.

and International Equities trend statuses at the start of each quarter.

>> STARFLUX— NEGATIVE, Starflux ended the week at -0.76 (down 26.67 % last week) This short-term indicator measures U.S. Equities.

>> STARPATH — NEGATIVE, This indicator measures the interplay on dual time-frames of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The big picture:

The ‘big picture’ is the (typically) years-long time-frame, the same time-frame in which Cyclical Bulls and Bears operate.

>> The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BEAR status at 47.62, up 4.38% from the prior week’s 45.62. It has signaled Bear since April 4, 2025.

>> The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 57.59, down 5.39% from the prior week’s 60.87. It has signaled Bull since December 15,

2023.

THIS WEEK IN THE MARKETS

U.S. Markets:

Markets mixed this week:

Stocks ended the week mixed as hopes for tariff de-escalation lifted investor sentiment. While the Dow Jones Industrial Average posted a modest decline, small- and mid-cap indexes extended their gains for a fifth straight week. The S&P 500 and Nasdaq Composite dipped 0.47% and 0.27%, respectively. Markets started the week on a weaker note, with the S&P 500 breaking a nine-day winning streak in a quiet Monday session. However, optimism returned midweek after reports emerged of upcoming U.S.–China trade talks in Switzerland, raising hopes for broader negotiations. Momentum continued as the U.S. and UK announced a new trade agreement—the first since the Trump-era tariffs— sparking investor optimism about the potential for further deals.

Looking at the US Indexes:

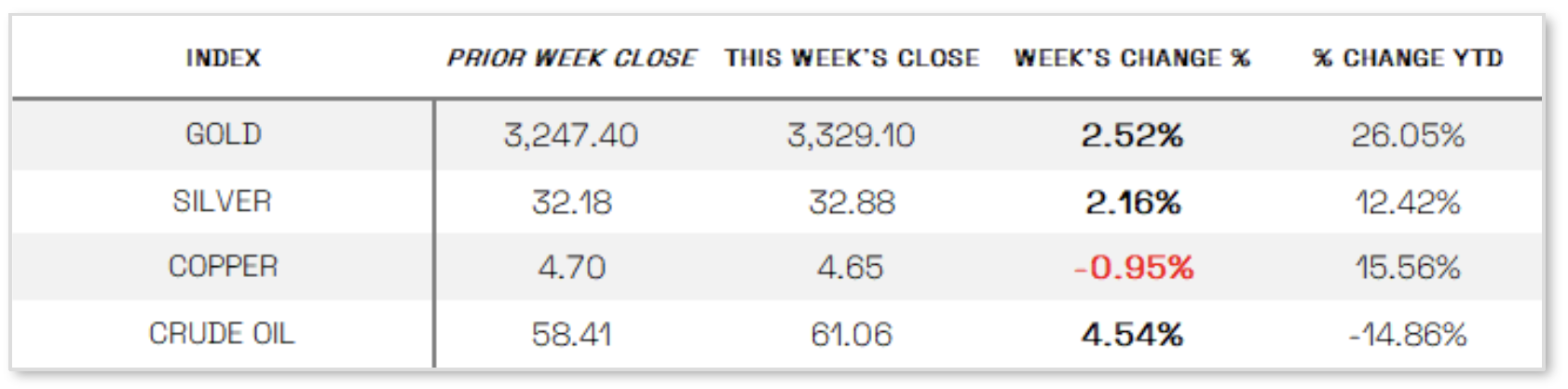

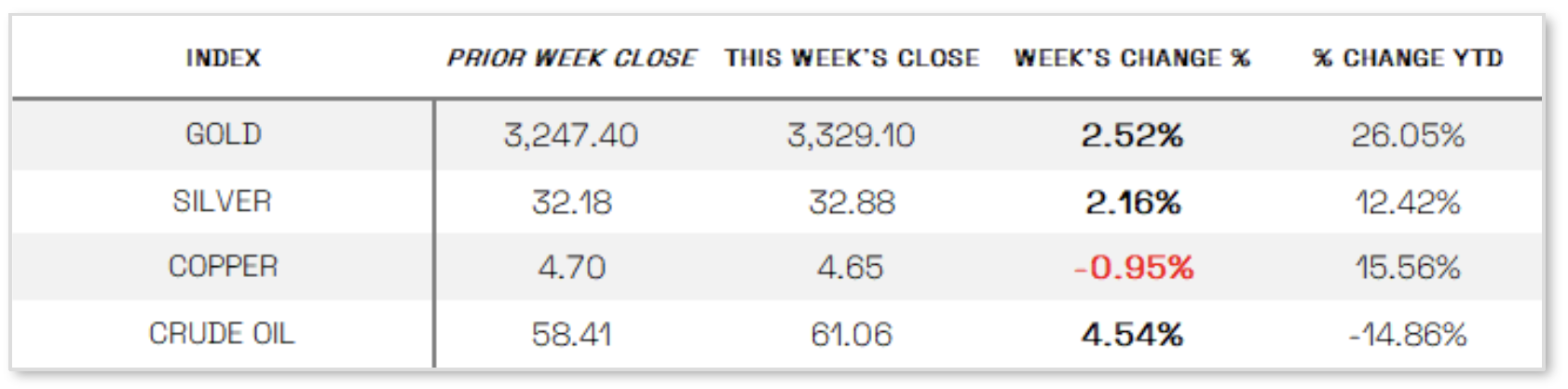

U.S. Commodities/Futures:

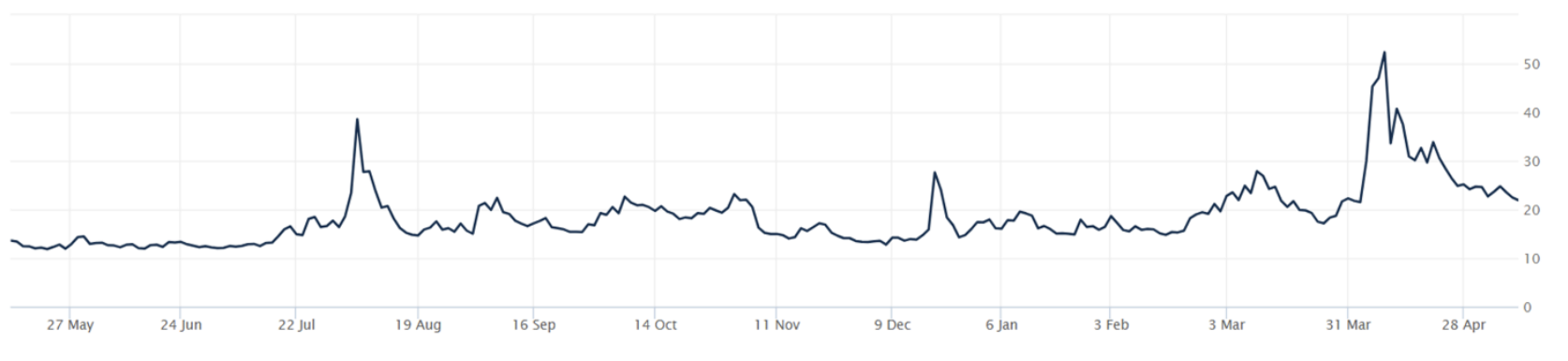

THE VOLATILITY INDEX (VIX) closed at 21.90 this week, a 3.4% decrease vs last week’s close of 22.68.

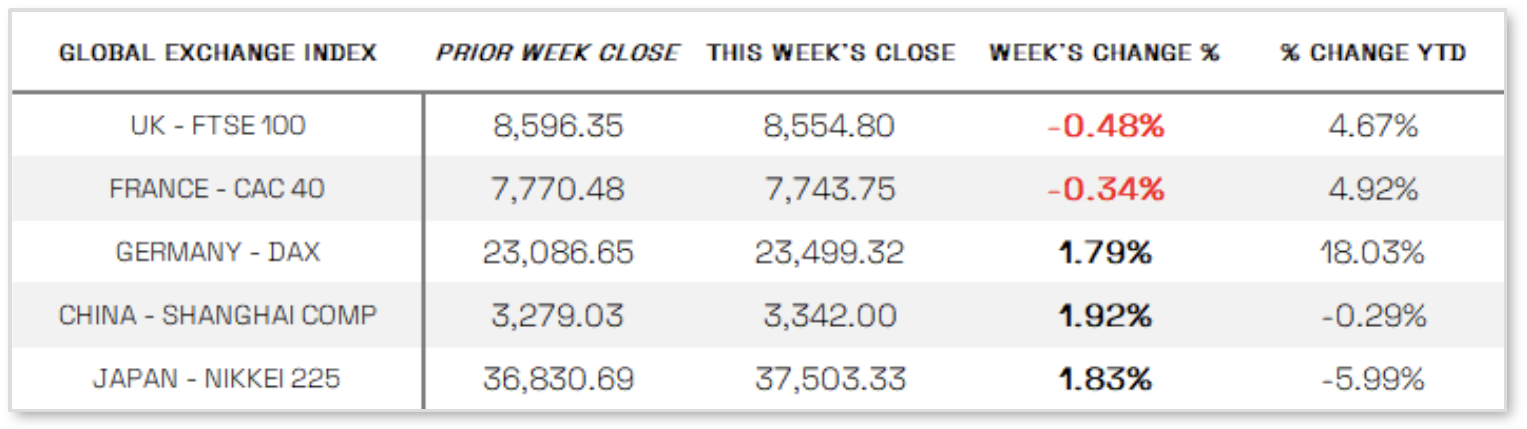

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News:Fed holds rates steady: The Federal Reserve held interest rates steady at 4.25% to 4.50% this week, citing growing uncertainty in the economic outlook despite ongoing solid growth. In its post-meeting

statement, the Fed warned of rising risks of both inflation and unemployment, while Chair Jerome Powell emphasized a cautious “wait and see” approach as policymakers evaluate the economic impact of recent policy changes, particularly tariffs. Powell acknowledged that conflicting pressures on inflation and employment may put the Fed’s dual mandate in tension. Futures markets reflected a lower probability of a rate cut at the Fed’s next meeting. Meanwhile, economic data was relatively light, though the ISM Services PMI rose to 51.6% in April, marking the 10th consecutive month of expansion, with improvements in most subindexes. However, the prices index jumped to 65.1%, its highest in over two years, largely due to tariffrelated cost pressures. In contrast, ISM’s Manufacturing PMI from the prior week showed a second month of contraction, as businesses continued to cut staff and respond to economic uncertainty.

International Economic News:

EUROPE: The pan-European STOXX Europe 600 Index rose 0.29% in local currency terms, marking its fourth straight weekly gain amid optimism over easing U.S.–China trade tensions, though performance across major markets was mixed—Germany’s DAX climbed 1.79%, Italy’s FTSE MIB rose 2.72%, while France’s CAC 40 and the UK’s FTSE 100 slipped 0.34% and 0.48%, respectively. The Bank of England cut its key rate by 25 basis points to 4.25% in a close 5–4 vote, leading markets to dial back expectations for further cuts this year, as policymakers emphasized a “gradual and careful” path forward. In Scandinavia, Sweden’s Riksbank held rates at 2.25% but signaled a potential shift toward easing due to growing downside risks, while Norway’s central bank kept its rate at 4.5%, citing persistent inflation and cautioning against premature cuts. Meanwhile, Germany saw a sharp 3% rise in industrial production and a 3.6% increase in factory orders for March, as manufacturers ramped up activity ahead of anticipated U.S. tariffs.

JAPAN: Japanese stock markets rose during the holiday-shortened week, with the Nikkei 225 gaining 1.83% and the TOPIX climbing 1.70%, as global trade optimism and a weaker yen—falling past JPY 145 against the U.S. dollar boosted investor sentiment. The yen’s slide was driven by a strengthening dollar following the announcement of a U.S.-UK trade deal and confirmation of upcoming U.S.-China trade talks. Meanwhile, the yield on 10-year Japanese government bonds rose to 1.35% as demand for safe-haven assets eased. Despite this positive market momentum, progress in U.S.-Japan trade negotiations remained limited, with U.S. officials warning that any deal could take much longer than the recent UK agreement; Japan is pressing for the removal of reciprocal tariffs, while the U.S. is focused on agricultural access. On the economic front, wage data disappointed, with real wages falling 2.1% year over year in March and nominal wage growth slowing to 2.1%, missing expectations. These weak figures add to concerns about the Bank of Japan’s ability to begin policy normalization, especially given ongoing global trade uncertainty

and downside risks to both growth and inflation.

CHINA: Mainland Chinese stock markets rose during a shortened trading week ahead of U.S.-China trade talks, with the CSI 300 Index up 2.00% and the Shanghai Composite gaining 1.92%, while Hong Kong’s Hang Seng Index climbed 1.61%, according to FactSet. Markets were buoyed by news that officials from both countries would meet in Switzerland for negotiations, as well as an unexpected policy boost from the People’s Bank of China (PBOC), which cut its seven-day reverse repo rate and the reserve requirement ratio, injecting around RMB 1 trillion in long-term liquidity. Additional rate cuts on various lending tools underscored Beijing’s efforts to shore up the economy following the U.S. announcement of a 145% tariff hike on most Chinese goods. April trade data showed exports rose 8.1% year over year—

exceeding expectations—but U.S.-bound shipments plunged 21%, partially offset by surging exports to India, Southeast Asia, and the EU. The upcoming trade talks, led by Chinese Vice Premier He Lifeng and U.S. Treasury Secretary Scott Bessent, are seen as pivotal, with analysts expecting that while the tariffs could hit Chinese exports and confidence, Beijing likely has the fiscal firepower to counter the impact through staged stimulus measures.

Sources:

>> All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal.

>> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute.

>> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update.html

Disclosures: This material and any mention of specific investments is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. The forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.