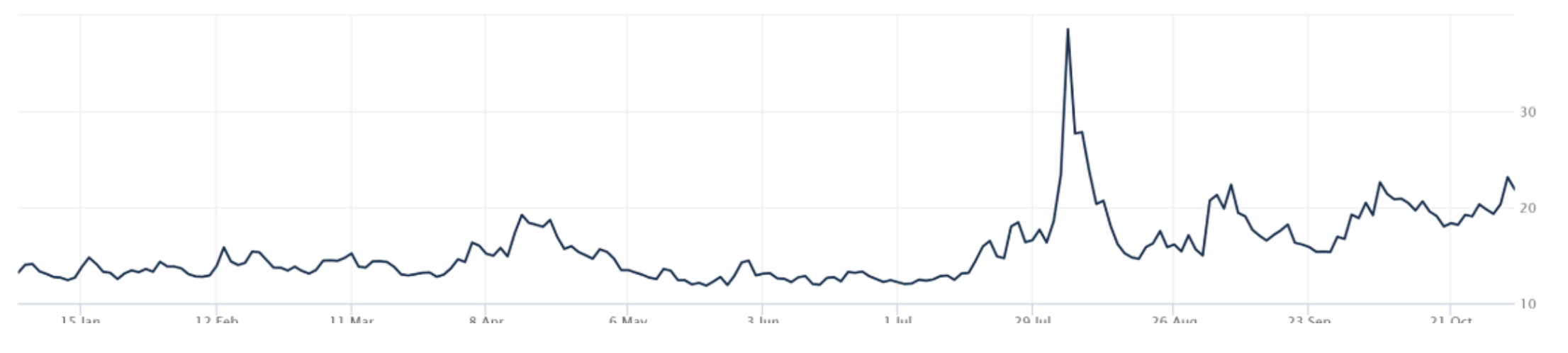

The very big picture (a historical perspective): The CAPE is now at 36.46.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30.

The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

HISTORY OF THE CAPE VALUE FROM 1871 TO PRESENT

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum. https://www.multpl.com/shiller-pe

The big picture: The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate. The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BULL status at 70.67, down 4.34% from the prior week’s 73.88. It has signaled Bull since April 21, 2023. The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 54.26, down 6.17% from the prior week’s 57.83. It has signaled Bull since December 15, 2023.

The shorter term picture: GALACTIC SHIELD — POSITIVE for Q4 2024 indicating positive prospects for equities in the fourth quarter of 2024. This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter. STARFLUX— POSITIVE, ended the week at 5.68 (down 17.80% last week) This short-term indicator measures U.S. Equities. STARPATH — POSITIVE, This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The complete picture (four indicators across three timeframes): When all four of the Sherman Portfolios indicators are in a POSITIVE status, we read the market as being in a BULL MARKET.

1. DELTA-V — Positive

2. GALACTIC SHIELD — Positive

3. STARFLUX— Positive

4. STARPATH — Positive

THIS WEEK IN THE MARKETS

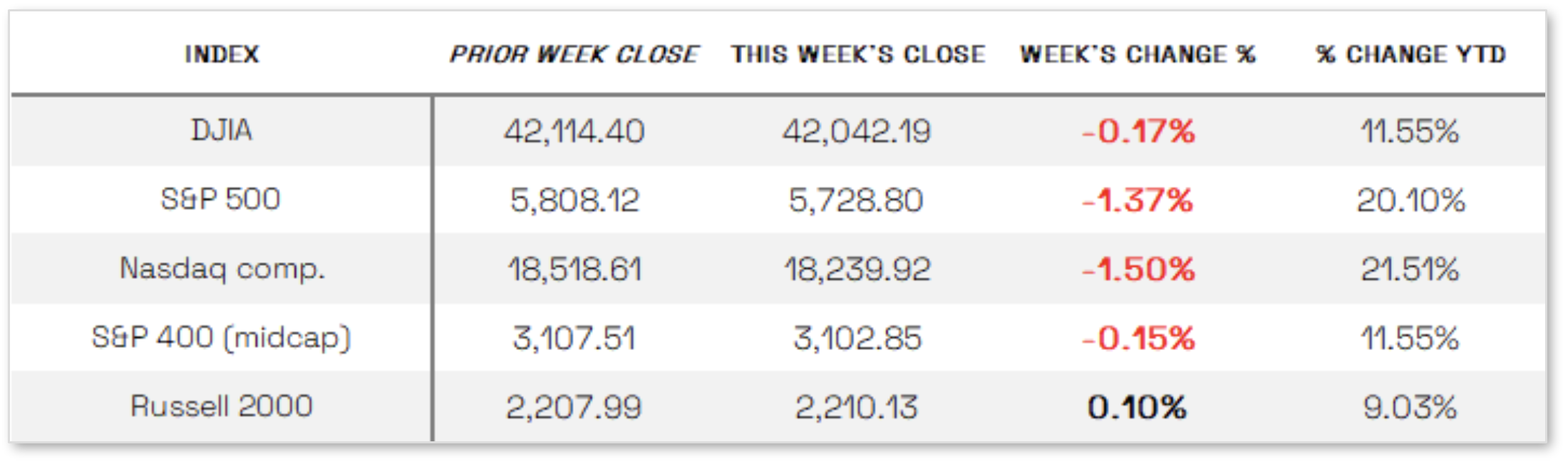

U.S. Markets: Busy week ends with stocks lower: The major indexes ended mostly lower after a busy week focused on both economic and earnings data, with the Nasdaq Composite and S&P MidCap 400 reaching record intraday highs on Wednesday before falling sharply on Thursday. Growth stocks generally trailed value stocks, influenced by cautious earnings reports from Meta Platforms and Microsoft, while small-cap stocks outperformed large-caps. Traders noted that around 42% of companies in the S&P 500 were set to report third-quarter earnings, including five of the “Magnificent Seven” mega-cap tech stocks—Meta, Microsoft, Alphabet, Apple, and Amazon. By Friday, analysts polled by FactSet expected S&P 500 earnings to have grown 5.1% year-over-year, a faster pace than the 4.3% growth anticipated at the start of the season.

Looking at the US Indexes:

The Dow Jones Industrial Average (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft). The Dow ended the week down 0.17% at 42,042.19 vs the prior week of 42,114.40.

The Nasdaq Composite Index tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks. The tech-driven Nasdaq ended the week down 1.50%, closing at 18,239.92 vs. the prior week of 18,518.61.

The S&P 500 large-cap index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall. The S&P 500 ended the week down 1.37%, closing at 5,728.80 compared to last week’s 5,808.12.

The S&P 400 mid-cap index is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks. The S&P 400 mid-cap ended the week down 0.15%, closing at 3,102.85 compared to last week’s 3,107.51.

The Russell 2000 (RUT) small-cap index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Russel 2000 ended the week up 0.10%, closing at 2,210.13 compared to last week’s 2,207.99.

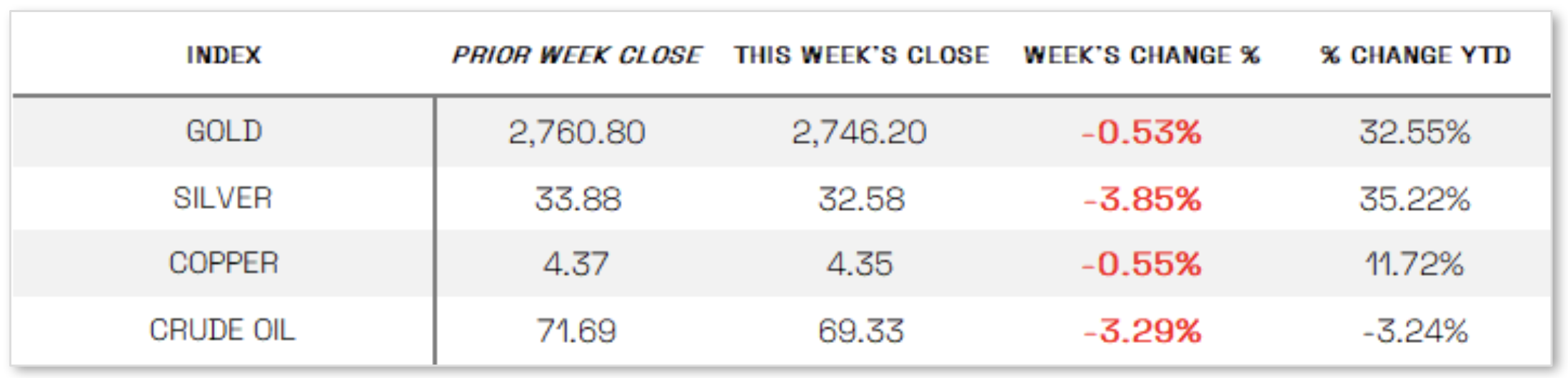

U.S. Commodities/Futures:

THE VOLATILITY INDEX (VIX) closed at 21.88 this week, a 7.6% increase vs last week’s close of 20.33.

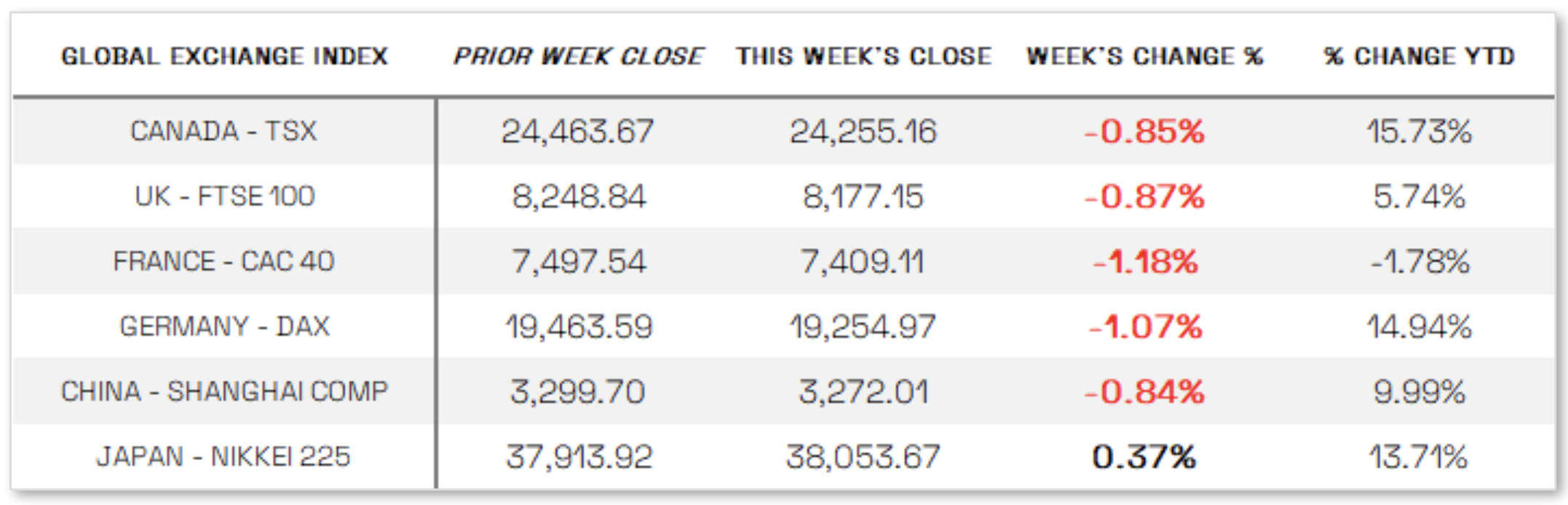

International Markets:

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News: Mixed Economic data: This week’s economic reports, especially on the labor market, drew significant attention with mixed indicators. On Tuesday, the Labor Department noted that job openings had dropped to 7.44 million in September—the lowest since January 2021—while voluntary job quits, a labor market strength measure, held steady. October payroll data, disrupted by Hurricanes Helene and Milton and the Boeing strike beginning September 13, showed unexpected fluctuations; private payroll firm ADP reported a 233,000 job increase, double expectations. Yet on Friday, the Labor Department reported that nonfarm payrolls barely rose, with only 12,000 jobs added—the smallest increase since December 2020—mainly due to a 44,000-job loss in transport equipment from the Boeing strike, while most industries saw little change. Average hourly earnings rose by 0.4%, slightly above expectations. Additionally, the Institute for Supply Management reported that manufacturing activity fell for the seventh month, hitting a 15-month low of 46.5 as subdued demand and policy uncertainty held companies back from investing in capital and inventory.

International Economic News: EUROPE: The pan-European STOXX Europe 600 Index fell 1.52%, driven by concerns over potential Middle East conflict escalation, weak corporate earnings, and diminishing hopes for European Central Bank rate cuts. Major European stock indexes also declined: France’s CAC 40 lost 1.18%, Germany’s DAX dropped 1.07%, Italy’s FTSE MIB slid 1.42%, and the UK’s FTSE 100 slipped 0.87%. In the eurozone, economic growth doubled to 0.4% in Q3, with Germany narrowly avoiding a recession and France and Spain exceeding growth expectations, though Italy’s economy stagnated. Inflation rose to 2% in October from 1.7% in September, mainly as lower energy prices from last year no longer affected annual comparisons, while core inflation held at 2.7%. In the UK, Chancellor Rachel Reeves presented the first Labour government budget in 14 years, introducing GBP 70 billion in extra spending over five years funded by GBP 40 billion in tax increases and GBP 32 billion in additional borrowing, and loosened fiscal rules for higher borrowing levels. The Office for Budget Responsibility warned the higher taxes might dampen long-term growth, adjusting its forecasts to just over 1% growth this year and 2% next year. To reassure investors after the budget triggered a bond market sell-off, Reeves emphasized Labour’s commitment to “economic and fiscal stability,” affirming that the public finances were now on a “stable and solid trajectory.”

JAPAN: Japan’s stock markets gained over the week, with the Nikkei 225 Index rising 0.4% and the TOPIX Index up 1.0%, as the Bank of Japan (BoJ) held rates steady amid ongoing political uncertainty. In the October 27 election, the ruling Liberal Democratic Party (LDP)-Komeito coalition failed to secure a majority in the lower house, with the opposition gaining ground due to public dissatisfaction over an LDP corruption scandal and rising living costs. Prime Minister Shigeru Ishiba’s LDP now faces the prospect of a minority government and is seeking support from smaller parties to maintain control. Following the election, the yen initially weakened against the U.S. dollar on expectations of political uncertainty potentially affecting fiscal policy and BoJ’s outlook. The BoJ held its policy rate steady at 0.25% as expected, and slightly less dovish comments from BoJ Governor Kazuo Ueda provided some support to the yen, which ended the week around JPY 152 per USD, close to its starting level.

CHINA: Chinese stocks declined despite data suggesting an uptick in economic activity. The Shanghai Composite Index fell 0.84%, and the blue-chip CSI 300 dropped 1.68%, while Hong Kong’s Hang Seng Index lost 0.41%, according to FactSet. China’s factory activity expanded for the first time since April, with the official manufacturing PMI rising to 50.1 in October from 49.8 in September, exceeding expectations and crossing the 50-mark that indicates growth. The nonmanufacturing PMI, covering construction and services, edged up to 50.2, supported in part by increased spending during the Golden Week holiday, although it missed forecasts. The Caixin/S&P Global survey of manufacturing activity also improved, reaching 50.3 in October from 49.3, amid new order growth. In the property sector, new home sales by the top 100 developers rose 7.1% year-on-year, a sharp recovery from September’s 37.7% decline, marking 2024’s first year-over-year increase, according to China Real Estate Information Corp.

Sources: All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal. >> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. >> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update

Disclosures: This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. Past performance cannot guarantee future results.