The very big picture (a historical perspective): The CAPE is now at 34.48– down 3.71% this month.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30. The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

HISTORY OF THE CAPE VALUE FROM 1871 TO PRESENT

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum. https://www.multpl.com/shiller-pe

The big picture: The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate. The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BULL status at 73.09, down 5.13% from the prior week’s 77.04. It has signaled Bull since April 21, 2023. The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 67.02, up 2.98% from the prior week’s 65.08 It has signaled Bull since December 15, 2023.

The shorter term picture: GALACTIC SHIELD — POSITIVE entering July 2024 (Q3) indicating positive prospects for equities in the second quarter of 2024. This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter. STARFLUX— POSITIVE since Nov 16, 2023 and ended the week at 0.67 (Down 78.53% last week) This short-term indicator measures U.S. Equities. STARPATH — POSITIVE since November 21, 2023. This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The complete picture (four indicators across three timeframes): When all four of the Sherman Portfolios indicators are in a POSITIVE status, we read the market as being in a CYCLICAL BULL MARKET.

1. DELTA-V — Positive

2. GALACTIC SHIELD — Positive

3. STARFLUX— Positive

4. STARPATH — Positive

THIS WEEK IN THE MARKETS

U.S. Markets: Market downturn towards end of week. The major benchmarks closed lower as investors reacted to the busiest week of the quarterly earnings reporting season and a crucial week of monthly economic data. The recent shift toward value stocks and small-caps stalled, with the small-cap Russell 2000 Index pulling back sharply at the week’s end. However, an equal-weighted version of the large-cap S&P 500 Index performed better than its market-weighted counterpart, indicating a broader market performance beyond the “Magnificent Seven” and other tech giants. The Nasdaq Composite fell over 10% from its July high, entering a technical correction. Companies representing nearly 40% of the S&P 500’s market capitalization reported second-quarter earnings, including Microsoft, Meta Platforms, Apple, and Amazon.com. Despite varied results relative to expectations, a common theme was heavy capital spending to develop artificial intelligence (AI) capabilities. Amazon.com shares dropped over 11% following its earnings report, revealing over USD 30 billion in capital expenditures in the first half of the year, expected to grow in the second half, mainly to support AI in its cloud computing division, AWS. Microsoft spent USD 19 billion in the second quarter alone, with increased spending anticipated, while Meta planned to spend approximately USD 37 billion–USD 40 billion in the second half, and Alphabet projected around USD 24 billion in spending over the same period.

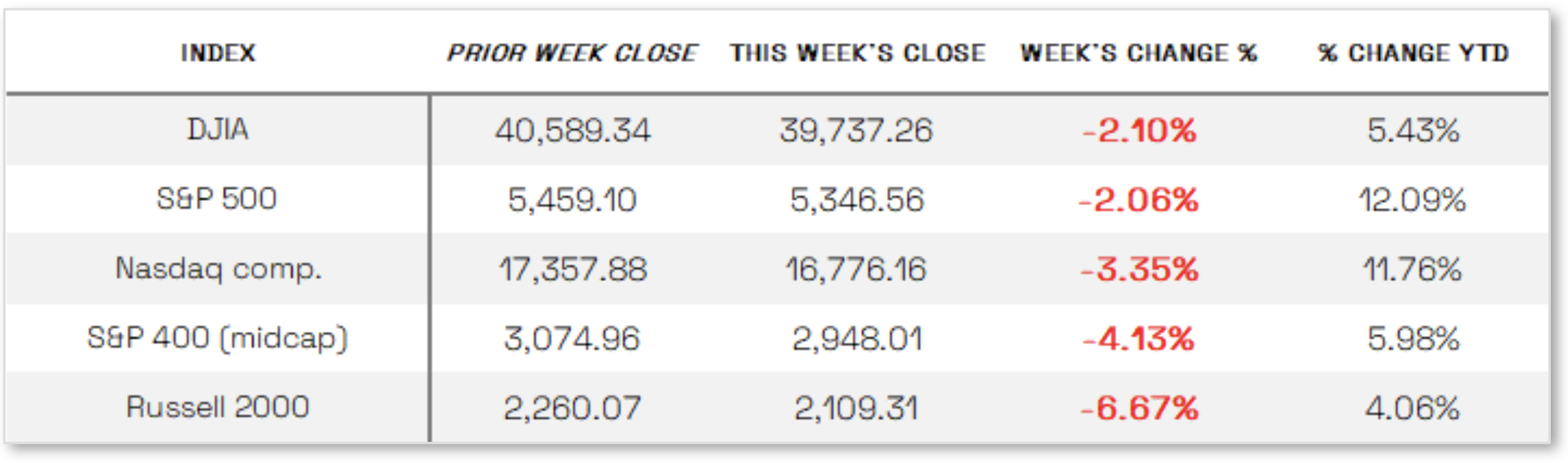

Looking at the US Indexes:

The Dow Jones Industrial Average (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft). The Dow showed a loss this week, ending the week down 2.10% to end at 39,737.26 vs the prior week of 40,589.34

The Nasdaq Composite Index tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks. The tech-driven Nasdaq showed losses this week. NASDAQ was down 2.06% by closing this week, ending at 16,776.16 vs. the prior week of 17,357.88.

The S&P 500 large-cap index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall. The S&P 500 was in the red this week. It was down 2.06%, closing at 5,346.56 compared to last week’s 5,459.10.

The S&P 400 mid-cap index is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks. The S&P 400 mid-cap was in the red this week, down 4.13%. It went from last week’s close of 3074.96 to 2948.01.

The Russell 2000 (RUT) small-cap index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Russel 2000 was down 6.67% for the week, closing at 2109.31 compared to last week’s 2260.07.

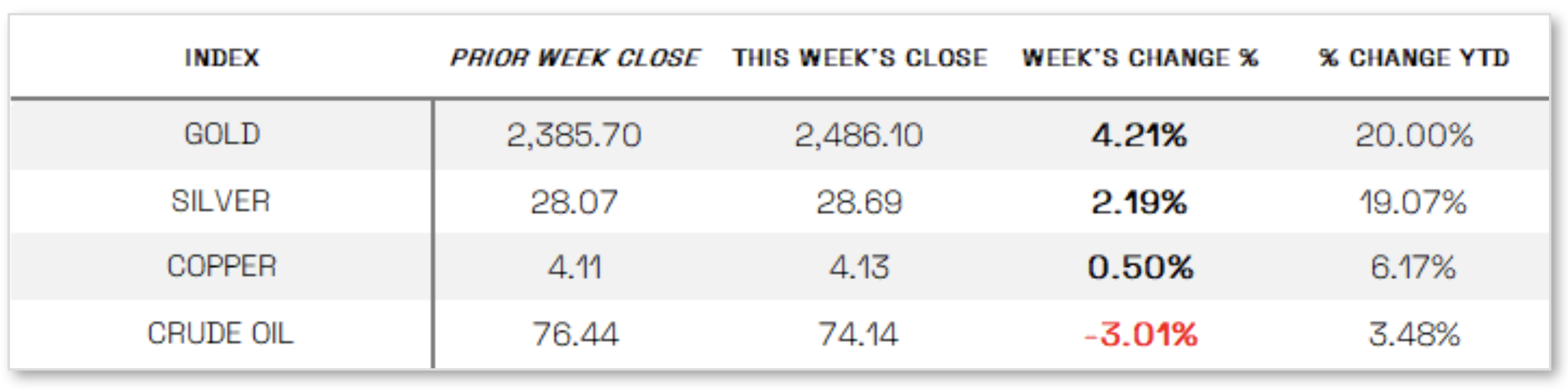

U.S. Commodities/Futures: Commodities were down this week, showing poor performance.

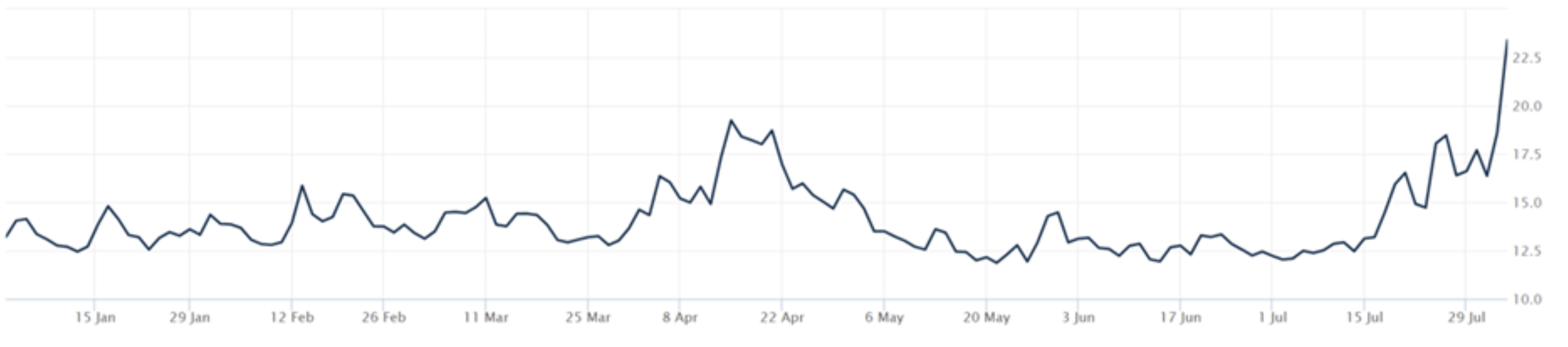

The Volatility Index (VIX) closed at 23.39 this week, a 42.71% increase vs last week’s close of 16.39.

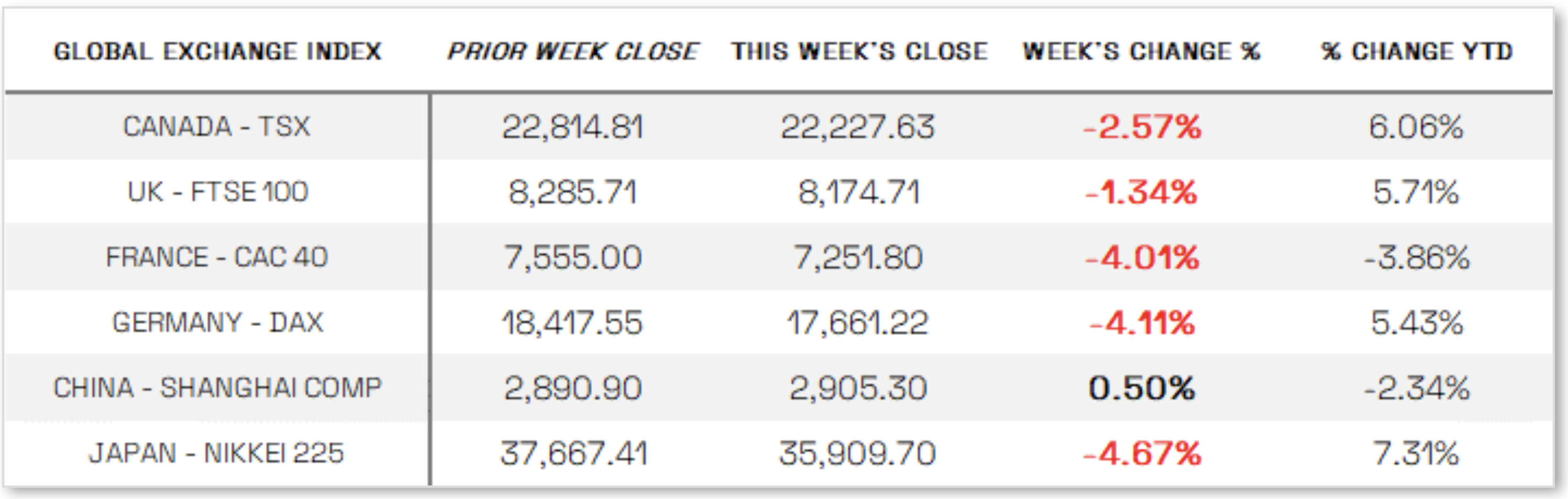

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News:

Continued cooling in labor market: On the macro front, sentiment was primarily driven by Friday’s nonfarm payrolls report, which indicated a more rapid cooling in the labor market than anticipated. The Labor Department reported that the economy added only 114,000 jobs in July, well below expectations and the lowest in three months, with only 97,000 jobs from the private sector, the least in 15 months. The unemployment rate also jumped from 4.1% to 4.3%, the highest since October 2021. Earlier, the Labor Department noted that voluntary job quits fell to 3.82 million in June, the lowest since November 2020, a key indicator of labor market conditions. Additionally, job openings fell slightly to 8.18 million but stayed above the April low of 7.92 million. Another factor shaking confidence in the economy was the unexpected drop in the Institute for Supply Management’s gauge of July manufacturing activity to 46.6, the lowest since last November, indicating nearly two years of continuous contraction in the sector. Interestingly, manufacturing jobs remained steady in July, while the tech sector shed 20,000 jobs.

International Economic News:

EUROPE: The pan-European STOXX Europe 600 Index fell 2.92% in local currency terms as weak U.S. economic data sparked growth concerns, causing major stock indexes to decline: Germany’s DAX dropped 4.11%, France’s CAC 40 fell 4.01%, Italy’s FTSE MIB lost 5.30%, and the UK’s FTSE 100 declined 1.34%. UK gilt yields decreased following the Bank of England’s (BoE) first rate cut in four years, reducing its key interest rate by a quarter point to 5.00%, a move passed by a 5-4 vote. Governor Andrew Bailey emphasized a cautious approach to further cuts to ensure low inflation. German bund yields also fell amid expectations of more rate cuts from the European Central Bank. In the eurozone, annual inflation increased to 2.6% in July from 2.5% in June, contrary to expectations of a decline to 2.4%, though services inflation eased for the first time in three months. Inflation varied across countries, easing in Spain but rising in Germany, France, and Italy. The region’s economy grew 0.3% sequentially (0.6% year-over-year) in the second quarter, driven by growth in France, Italy, and Spain, while Germany’s economy unexpectedly contracted. The unemployment rate rose to 6.5% in June from 6.4% in May, but consumer confidence in the euro area improved steadily since February, bolstered by optimism about declining borrowing costs.

JAPAN: During a week marked by a hawkish shift from the Bank of Japan (BoJ), Japan’s stock markets suffered significant losses, with the Nikkei 225 Index falling 4.67% and the broader TOPIX Index dropping 6.0%. Disappointing U.S. macroeconomic data further dampened investor risk appetite, leading to one of the biggest one-day drops in the Nikkei’s history, comparable to those during the March 2020 coronavirus pandemic and the October 1987 “Black Monday” crash. The yen’s rebound to around JPY 148.9 against the U.S. dollar from JPY 153.7 the previous week continued to hamper earnings outlooks for Japan’s export-oriented companies. In the fixed income market, the yield on the 10-year Japanese government bond (JGB) fell to 0.98% from 1.06%. The BoJ raised its key short-term interest rate to around 0.25% from 0% to 0.1%, marking its second hike this year, and outlined plans to taper bond purchases to about JPY 3 trillion in the first quarter of 2026, reducing purchases by about JPY 400 billion each quarter. Additionally, the BoJ lowered its core inflation outlook for fiscal year 2024 to 2.5% from 2.8% and slightly cut its growth outlook to 0.6% from 0.8%.

CHINA: Chinese equities showed mixed performance as weak manufacturing data dampened investor sentiment. The Shanghai Composite Index rose 0.5%, while the blue-chip CSI 300 fell 0.73%. In Hong Kong, the Hang Seng Index declined 0.45%. The official manufacturing Purchasing Managers’ Index (PMI) slipped to 49.4 in July from 49.5 in June, marking the third consecutive monthly contraction with declines in production and new orders, as reported by the National Bureau of Statistics. The nonmanufacturing PMI, measuring construction and services activity, dropped to 50.2 from 50.5 in June, attributed to seasonal factors and extreme weather. Separately, the private Caixin/S&P Global survey showed an unexpected contraction in manufacturing activity for the first time in nine months, with the Caixin PMI falling to 49.8 in July from 51.8 in June, indicating slowing momentum in China’s export sector. Despite these challenges, industrial profits rose by 3.6% in June year-over-year, up from 0.7% in May, driven by stronger industrial production and slower producer price declines. However, ongoing weakness in domestic demand has fueled speculation that Beijing will introduce further measures to stimulate the economy, as recent efforts have struggled to boost consumption.

Sources: All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal. >> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. >> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update.

Disclosures: This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. Past performance cannot guarantee future results.