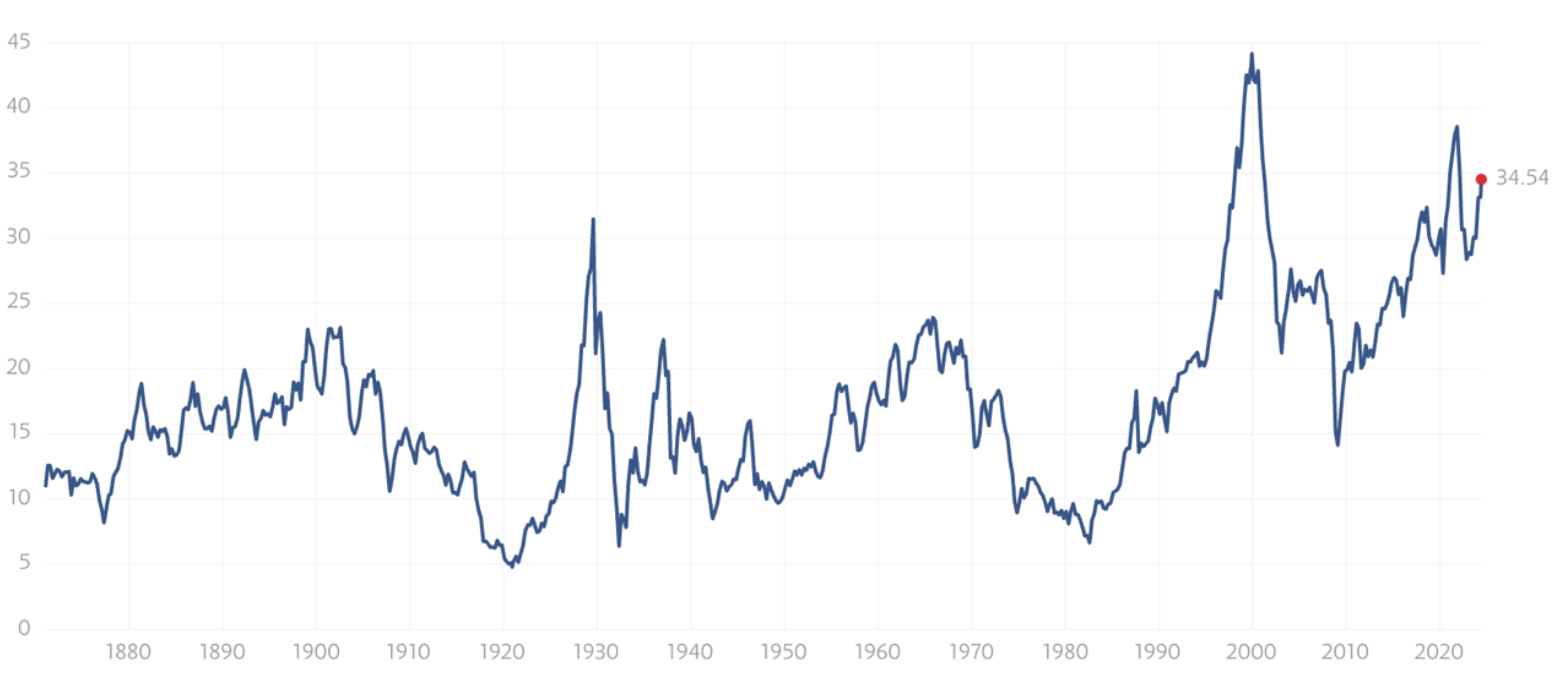

The very big picture (a historical perspective): The CAPE is now at 34.53 – ending May up 1.44%.

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30. The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

HISTORY OF THE CAPE VALUE FROM 1871 TO PRESENT

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum. https://www.multpl.com/shiller-pe

The big picture: The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate. The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BULL status at 71.84, down 2.38% from the prior week’s 74.22. We’ve been in a cyclical Bull Market since April 21, 2023.

The shorter term picture: GALACTIC SHIELD — POSITIVE entering April 2024 (Q2)indicating positive prospects for equities in the second quarter of 2024. This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter. STARFLUX— POSITIVE since Nov 16, 2023 and ended the week of 5/31/24 at 5.47 (Down -0.62) This short-term indicator measures U.S. Equities. STARPATH — POSITIVE since November 21, 2023. This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The complete picture (four indicators across three timeframes): When all four of the Sherman Portfolios indicators are in a POSITIVE status, we read the market as being in a CYCLICAL BULL MARKET.

1. DELTA-V — Positive

2. GALACTIC SHIELD — Positive

3. STARFLUX— Positive

4. STARPATH — Positive

THIS WEEK IN THE MARKETS

U.S. Markets: GROWTH SHARES LEAD STOCKS LOWER. Most of the major benchmarks closed lower over the holiday-shortened week but rounded out a month of gains. In contrast to much of the month, small-caps performed better than large-caps, and value stocks held up better than growth shares. The technology-heavy Nasdaq Composite was especially weak, due in part to a sharp decline in cloud software provider Salesforce, which fell sharply after releasing first-quarter revenues that missed consensus estimates. Markets were shuttered Monday in observance of the Memorial Day holiday.

The catalysts for the week’s moves were arguably harder to detect than usual. Much of the week’s relatively light economic calendar came in roughly in line with expectations, most notably the Commerce Department’s personal consumption expenditure (PCE) price index report, released Friday morning. Core (less food and energy) PCE prices—widely considered the Federal Reserve’s preferred inflation gauge—rose 0.2% in April, down slightly from the previous two months and seemingly a period of calming inflation pressures following January’s 0.5% spike.

Looking at the US Indexes:

The Dow Jones Industrial Average (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft). The Dow continued to decline after last weeks turn, ending the week of May 31 by losing -0.98% to end at 38,686.32 vs the prior week of 39,069.59.

The Nasdaq Composite Index tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks. The tech-driven Nasdaq joined the Dow and large-cap indexes this week in losses. NASDAQ lost -1.10% by closing this week, ending at 16,735.02 vs. the prior week of 16,920.79.

The S&P 500 large-cap index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall. The S&P 500 lost 0.51% ending at 5,277.51 vs last week’s close of 5,304.72.

The S&P 400 mid-cap index is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks. The S&P 400 mid-cap changed stayed in the black this week, reporting a humble increase of 0.21%. The index closed at 2,982.86 vs last week’s 2,976.67.

The Russell 2000 (RUT) small-cap index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Russel 2000 joined the midcap index also reporting positive, albeit small gains. The small-cap index reported a gain of 0.02% and closed at 2,070.13 vs last week’s close of 2,069.67.

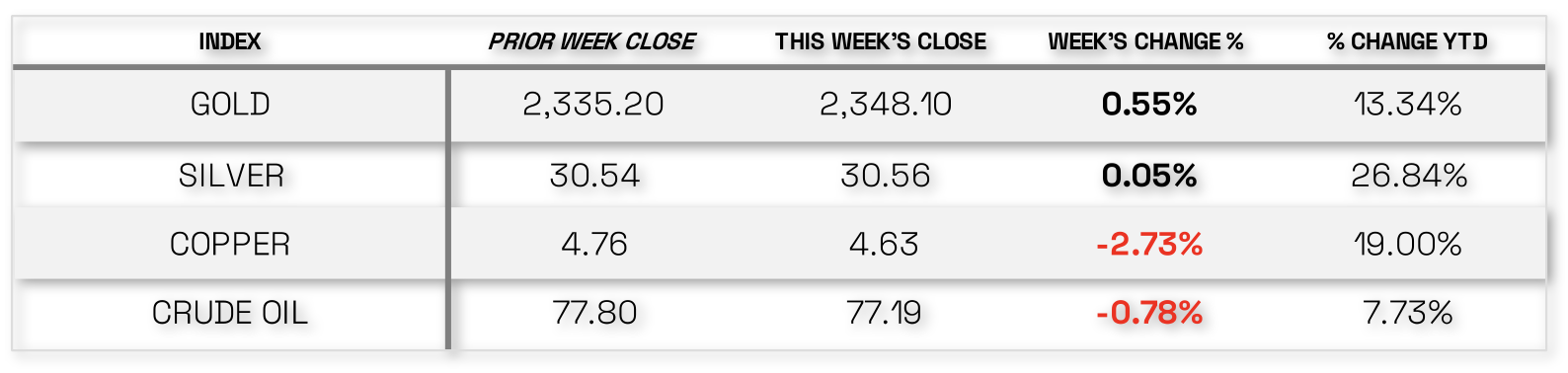

U.S. Commodities/Futures: In a total change of events versus last week, Commodities all reversed trajectory and saw losses across the board.

VIX closed at 12.92 this week, an 8.3% increase over last week’s close of 11.93.

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News: RISING HOME PRICES AND MORTGAGE RATES SEEM TO WEIGH ON SALES. “Supercore” inflation—PCE services excluding energy and housing—which has lately become more of a focus because of the unusual dynamics of housing and rental costs—offered a more mixed picture, rising 0.3%, down a tick from March but a tick up from February’s increase. Separately, the Case-Shiller index of housing prices in major U.S. cities, reported Tuesday, rose 7.4% over the 12 months ended in March, the highest level since October 2022.

The impact of the continued increase in home prices and mortgage rates was seemingly reflected in a 5.7% decline in mortgage applications over the previous week, the biggest drop since February. Pending home sales in April also slumped 7.7%, their biggest drop in over three years and well below expectations.

WEAK TREASURY AUCTIONS RAISE CONCERNS. One prominent factor weighing on sentiment, according to T. Rowe Price traders, appeared to be the Treasury Department’s midweek auctions of five- and seven-year notes, which were met with subdued demand (as indicated by the so-called bid-to-cover ratio). According to Traders, the weak sales raised concerns that funding the U.S. deficit will drive up yields at a time when the Fed appears to be in no rush to cut rates.

Traders noted that Minneapolis Fed President Neel Kashkari may have contributed to a sell-off on Tuesday by saying, “I don’t think anybody has totally taken rate increases off the table. I think the odds of us raising rates are quite low, but I don’t want to take anything off the table.” Generally, however, fixed income investors appeared to welcome the signs of stabilizing inflation, driving the yield on the benchmark 10-year U.S. Treasury note lower for the week.

Overall, Traders noted that fixed income markets were relatively subdued following the holiday weekend. In particular, Traders reported significantly below-average activity in the high yield segment as trading resumed after the holiday weekend. However, the broader macro backdrop weighed on the performance of below investment-grade bonds, which experienced weakness alongside rates and equities. In a reversal of the trend seen over the previous few weeks, high yield funds reported negative flows.

International Economic News: In local currency terms, the pan-European STOXX Europe 600 Index ended 0.46% lower as hotter-than-expected eurozone inflation increased uncertainty about policy easing by the European Central Bank (ECB) beyond June. Major stock indexes also fell over this period. France’s CAC 40 Index dropped 1.26%, while Germany’s DAX declined 1.05%. Italy’s FTSE MIB ended the week flat. The UK’s FTSE 100 Index lost 0.51%.

EUROZONE INFLATION STRONGER THAN EXPECTED; JOBLESS RATE AT RECORD LOW. Headline inflation in the eurozone rose for the first time in five months, with the year-over-year increase in consumer prices ticking up to 2.6% in May from 2.4% in each of the previous two months. This reading exceeded a consensus estimate of 2.5%. Services inflation accelerated to 4.1% from 3.7% in April. Meanwhile, a measure of core inflation that excludes energy, food, alcohol, and tobacco prices increased to 2.9% from 2.7%.

The unemployment rate fell to a record low of 6.4% in April after coming in at 6.5% in each of the prior five months. The number of unemployed people decreased by 100,000 from the previous month to 10.998 million.

ECB’S LANE: READY TO CUT RATES—A BIT. ECB Chief Economist Philip Lane signaled that borrowing costs would probably be lowered at the June 6 meeting. He told the Financial Times newspaper: “Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.” However, the newspaper reported that Lane said the pace at which the central bank eases borrowing costs this year would depend on incoming economic data. “The best way to frame the debate this year is that we still need to be restrictive all year long,” he added. “But within the zone of restrictiveness we can move down somewhat.”

BANK OF ENGLAND MORTGAGE APPROVALS DIP; NATIONWIDE SAYS HOUSE PRICES REBOUND. In the UK, net mortgage approvals for house purchases inched lower to 61,140 in April, below market expectations for 61,500. The Bank of England revised the number of mortgage approvals for March down to 61,260.

The Nationwide Building Society’s house price index in May rose 0.4% sequentially, after falling in the previous two months. The index was 1.3% higher on a year-over-year basis.

JAPAN: Japan’s stock markets generated mixed weekly returns, with the Nikkei 225 Index falling 0.4% and the broader TOPIX Index gaining 1.1%. A downward revision to U.S. economic growth data increased the likelihood that the Federal Reserve may cut interest rates at least once before the end of this year, lending some support to risk appetite globally.

CONTINUED SPECULATION ABOUT FURTHER MONETARY POLICY NORMALIZATION. Investors’ focus remained firmly on the prospect and likely timing of further monetary policy normalization by the Bank of Japan (BoJ). The yield on the 10-year Japanese government bond (JGB) rose to 1.07%, from 1.00% at the end of the previous week, amid continued uncertainty about when the BoJ could next raise short-term interest rates. The central bank ended its negative interest rate policy in March, although Japan’s monetary policy remains among the most accommodative in the world.

DATA WIDELY EXPECTED TO SHOW THAT AUTHORITIES INTERVENED TWICE TO PROP UP THE YEN. In the currency markets, the yen depreciated to around JPY 157.3 against the U.S. dollar, from about 157.0 at the end of the prior week. With the yen continuing to hover around 34-year lows, investors awaited monthly data (due to be released after the market’s close on Friday) on how much authorities spent on currency intervention during the period from April 26 to May 29. The data are widely expected to show that authorities stepped into the foreign exchange markets on two separate occasions late in the period to prop up the Japanese currency.

INFLATION ACCELERATES IN TOKYO AREA BUT REMAINS BELOW BOJ’S TARGET. The Tokyo-area core consumer price index, a leading indicator of nationwide trends, showed that the rate of consumer inflation accelerated in May to 1.9% year on year, in line with expectations and following an increase of 1.6% in April. Despite the acceleration, attributable largely to rising electricity bills, inflation remained below the BoJ’s 2% target, reducing pressure on the central bank to raise interest rates soon. Separate data showed that retail sales rose more than anticipated in April, with consumption buoyed by signs of rising wages, while industrial output unexpectedly fell over the same month.

CHINA: Chinese equities were little changed after an unexpectedly weak manufacturing reading highlighted growth headwinds on the economy. The Shanghai Composite Index was broadly flat, while the blue chip CSI 300 gave up 0.6%. In Hong Kong, the benchmark Hang Seng Index lost 2.84%, according to FactSet.

MANUFACTURING SLIPS BACK INTO CONTRACTION. The official manufacturing purchasing managers’ index (PMI) fell to a below-consensus 49.5 in May from 50.4 in April, marking the first monthly contraction since February. The gauge lagged the 50-mark level, separating growth from contraction. The PMI’s subindexes for new orders and exports also declined. The non-manufacturing PMI, which measures construction and services activity, slipped to a weaker-than-expected 51.1 from 51.2 in April amid slower construction growth. Separately, profits at industrial firms rose by 4% in April from a year ago and recovered from a 3.5% decline in March, according to the National Bureau of Statistics. Analysts said increased overseas demand and a government push for domestic companies to upgrade their aging equipment drove April’s increase.

Although both PMI readings underscored pockets of weakness in China’s economy, most economists believe that China will meet its growth target this year of around 5%. Earlier in the week, the International Monetary Fund upgraded its 2024 economic growth forecast for China to 5%, up from its April projection of 4.6%, following Beijing’s support measures and a stronger-than-expected first-quarter expansion.

On the policy front, officials in Shanghai announced measures to shore up home buying demand in China’s largest city. Measures included lowering the minimum down payment ratio for home purchases, reducing the minimum interest rates on first home mortgages, and relaxing social insurance and income tax payment requirements for non-Shanghai residents. The easing of home buying rules in Shanghai comes after the central government earlier in May rolled out a historic rescue package for China’s ailing property sector, which has emerged as a major growth headwind and left the economy dependent on exports.

Sources: All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal >> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. >> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update

Disclosures: This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. Past performance cannot guarantee future results.