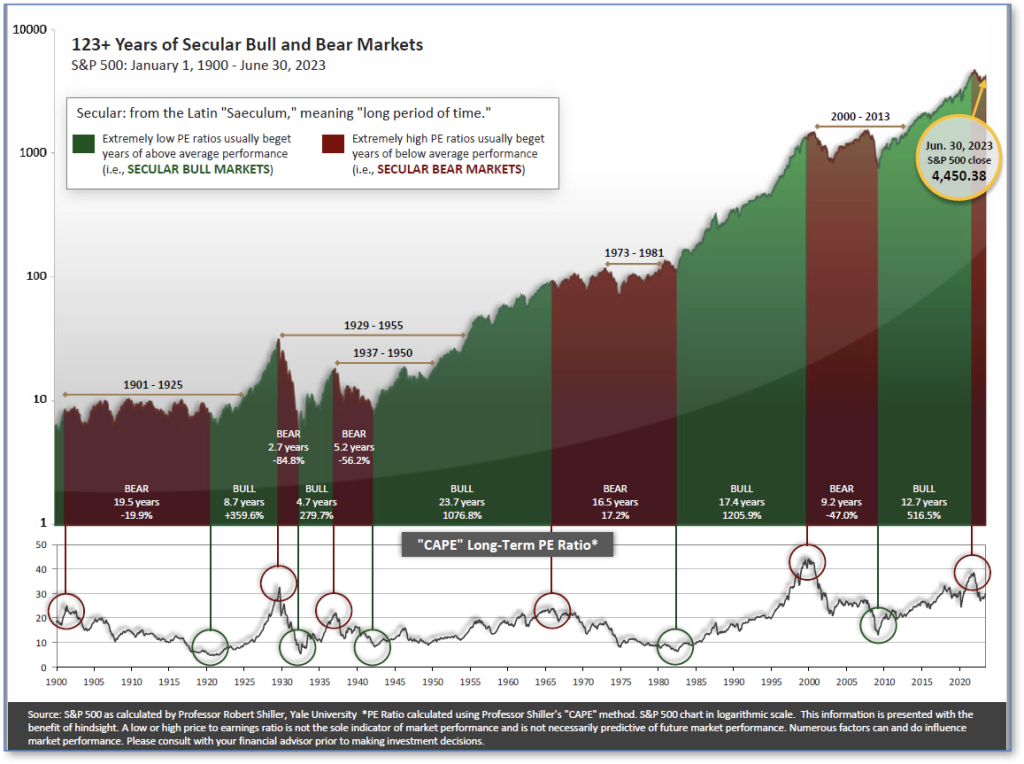

The very big picture (a historical perspective):

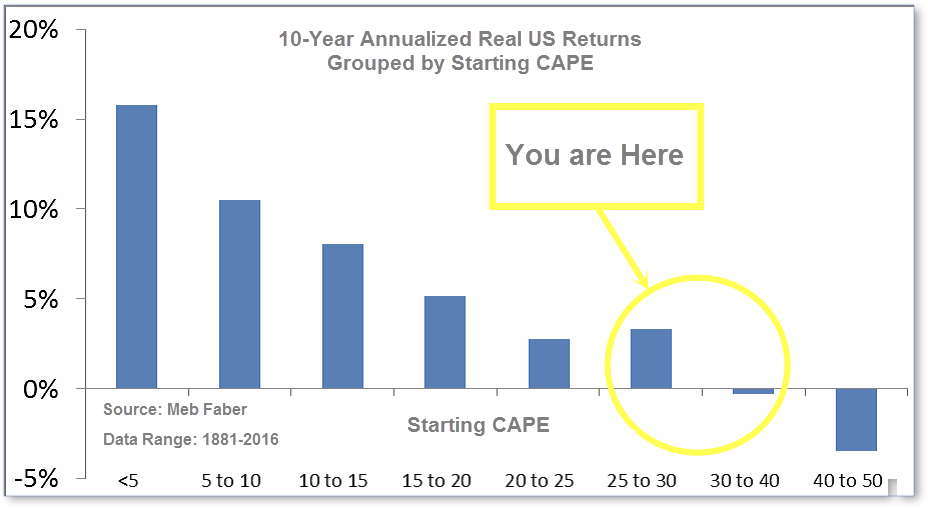

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. A CAPE level of 30 is considered to be the upper end of the normal range, and the level at which further PE-ratio expansion comes to a halt (meaning that further increases in market prices only occur as a general response to earnings increases, instead of rising “just because”). The market was recently above that level and has fallen back.

Of course, a “mania” could come along and drive prices higher – much higher, even – and for some years to come. Manias occur when valuation no longer seems to matter, and caution is thrown completely to the wind – as buyers rush in to buy first, and ask questions later. Two manias in the last century – the “Roaring Twenties” of the 1920s, and the “Tech Bubble” of the late 1990s – show that the sky is the limit when common sense is overcome by a blind desire to buy. But, of course, the piper must be paid, and the following decade or two were spent in Secular Bear Markets, giving most or all of the mania-gains back.

See Fig. 1 for the 100-year view of Secular Bulls and Bears.

The CAPE is now at 31.92, up from the prior week’s 31.15. Since 1881, the average annual return for all ten-year periods that began with a CAPE in this range has been slightly positive to slightly negative (see Fig. 2).

Note: We do not use CAPE as an official input into our methods. However, if history is any guide – and history is typically ‘some’ kind of guide – it’s always good to simply know where we are on the historic continuum, where that may lead, and what sort of expectations one may wish to hold in order to craft an investment strategy that works in any market ‘season’ … whether the current one, or one that may be ‘coming soon’!

The big picture:

As a reading of our Bull-Bear Indicator for U.S. Equities (comparative measurements over a rolling one-year timeframe), we entered a new Cyclical Bull on April 21, 2023.

The complete picture:

Counting-up of the number of all our indicators that are ‘Up’ for U.S. Equities, the current tally is that four of the four are Positive, representing a multitude of timeframes (two that can be solely days/weeks, or months+ at a time; another, a quarter at a time; and lastly, the {typically} years-long reading, that being the Cyclical Bull or Bear status).

In the markets:

U.S. Markets: The S&P 500 Index, Nasdaq Composite, and Dow Jones Industrial Average reached their seventh straight week of gains. Small-caps outperformed this week as well. The Dow Jones Industrial Average rose 2.9%, closing the week at 37,305. The technology-heavy NASDAQ added 2.8%. By market cap, the large cap S&P 500 gained 2.5%, while the mid cap S&P 400 advanced 4.3%. The small cap Russell 2000 surged 5.5%.

International Markets: The majority of the international indexes finished the week in the green. Canada’s TSX increased 1.0%, while the UK’s FTSE 100 ticked up 0.3%. France’s CAC 40 rose 0.9%, while Germany’s DAX was essentially unchanged. In Asia, China’s Shanghai Composite retreated -0.9%. Japan’s Nikkei gained 2.1%. As grouped by Morgan Stanley Capital International, developed markets grew 1.6%, while emerging markets advanced 2.5%.

Commodities:Precious metals were up this week as well. Gold rose 1.05% to $2,035.70 an ounce and Silver gained 3.77% to $24.15. The industrial metal copper, viewed by some analysts as a barometer of world economic health due to its wide variety of uses, increased 1.57%. West Texas Intermediate crude oil ended its streak in the red, rising 0.77% to $71.78 per barrel.

U.S. Economic News: Core consumer prices increased 0.3% last month. Rents surged 0.5% in November and have increased 6.9% over the past year. Economists said that if shelter prices receded, inflation would slow more significantly in 2024. Used-vehicle prices rose 1.6% last month. Prices for clothing, home furnishings, plane tickets, hotel rentals, and new cars and trucks dropped off slightly. The core rate has been stuck near 4% for several months. The annual rate of inflation slowed from 3.2% in October to 3.1% in November. A drop in gasoline prices weighed down the headline CPI reading. Meanwhile, the cost of food ticked up 0.2%. Grocery prices continued to slowly climb. Higher borrowing costs reduced demand for labor, goods and services, which has slowed the economy. “Overall, this will do little to change the Fed’s recent communications that core inflation remains too strong to contemplate shifting to rate cuts any time soon,” said Michael Pearce, lead U.S. economist of Oxford Economics.

Wholesale prices flattened in November, according to the producer price index. The increase in wholesale prices over the past year have slowed from 1.2% to 0.9% in November. The government said that a measure of core wholesale prices, which omits food, energy, and trade margins, edged up 0.1% last month. The increase in core prices over the past year slowed from 2.8% to 2.5%. In November, energy prices sank 1.2% after a decline in the cost of oil. The cost of services flattened last month. The price for raw materials dropped 1.4%. The PPI report showed that wholesale prices have fallen further than consumer prices. Most senior Fed officials forecasted U.S. inflation will ease toward their 2% goal as higher interest rates slow the economy.

The Federal Reserve decided to hold its key interest rate steady this week. Policymakers on the Federal Open Market Committee unanimously voted to keep the benchmark overnight borrowing rate between 5.25%-5.5%. The statement said that the committee would take multiple factors into account before any more policy tightening. “While the weather is still cold outside, the Fed has suggested a potential thawing of frozen high interest rates over the next few months,” said Rick Rieder, chief investment officer of global fixed income at BlackRock. Committee members revised gross domestic product to grow at a 2.6% annualized pace in 2023, a half percentage point increase from the previous update in September. Projections for the unemployment rate were mostly unchanged at 3.8% for this year. “Recent indicators suggest that growth in economic activity has slowed substantially from the outsized pace seen in the third quarter. Even so, GDP is on track to expand around 2.5% for the year as a whole,” said Jerome Powell, Chair of the Federal Reserve.

Initial jobless claims dropped 19,000 to 202,000 this month, according to the U.S. Labor Department. Economists had estimated new claims would hold at 220,000. Last week’s jobless claims rose a revised 20,000 to 221,000. The number of people already collecting jobless benefits rose by 20,000 to 1.876 million. On an unadjusted basis, claims lost 46,316 to 248,299. While jobless claims have remained volatile during the holiday season, economists seemed cautious on how to interpret the data. “When the dust settles, we expect to see initial claims trending at about 220,000,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Sales at U.S. retailers increased 0.3% in November, which marked an above-average start to the holiday shopping season. Economists had forecasted a 0.1% decline in sales. Retail sales represent about a third of all consumer spending. Americans spent more on clothes, furniture, health-care items and new cars and trucks. Sales also surged at stores that sell books, music, and at Internet retailers. Bars and restaurants had a strong climb in sales at 1.6% in November. In the past year, restaurant sales had increased 11%. Gasoline stations saw a sharp decrease in receipts last month. Department stores and home centers also saw a decline in sales. Setting aside car dealers and gas stations, retail sales climbed 0.6%. “The big jump in retail sales shows that the death of the consumer — as well as the economy — has been greatly exaggerated and the much-hyped recession of 2023 isn’t going to materialize,” chief investment officer for Independent Advisor Alliance, Chris Zaccarelli, said.

International Economic News: In Canada, higher borrowing costs slowed groundbreaking on multiple unit and single-family homes, data from the Canadian Mortgage and Housing Corporation (CMHC) showed. Consequently, Canadian housing starts plunged 22% in November from the prior month. The seasonally adjusted annualized rate of housing starts dropped from 272,264 units in October to 212,624 units last month, the CMHC said. Economists had forecasted housing starts to decrease to 257,100. “The notable drop in the rate of housing starts in November, particularly in the multi-unit space, should not come as a major surprise and reflects tighter economic conditions impacting construction timelines,” said Kevin Hughes, CMHC’s deputy chief economist. “As the more difficult borrowing conditions and labour shortages now seem to be showing in the starts numbers, we can expect to see continued slower starts rates in the coming months,” Hughes added.

Across the Atlantic, Britain’s economy contracted in October, data from the Office for National Statistics showed this week. The Bank of England’s resolve to hold interest rates steady may raise the risk of a recession. Gross domestic product (GDP) dropped off by 0.3% from September, the Office for National Statistics said. Economists had expected GDP would be unchanged in October. Chief UK economist at Capital Economics, Paul Dales, said the October data suggested Britain might be in a recession. “That may nudge the Bank of England a little closer to cutting interest rates, although when leaving rates at 5.25% tomorrow the Bank will probably push back against the idea of near-term rate cuts,” Dales said. Elizabeth Martins, at Hongkong and Shanghai Banking Corporation (HSBC), expected another 6 to 3 vote by the Bank of England’s Monetary Policy Committee to keep rates unchanged, but the weak GDP data may prompt the three MPC members to join the no-change majority. “If the BoE’s hawks wanted to push back on market expectations of rate cuts starting mid-next year, the data are giving them very little work with,” said Martins.

On Europe’s mainland, German economic activity dropped off in December’s PMI reading. Germany’s economic downturn worsened as manufacturing and services activity contracted this month, a preliminary survey showed. The Hamburg Commercial Bank German Flash Composite Purchasing Managers’ Index (PMI), compiled by S&P Global, fell for the sixth straight month, declining from November’s 47.8 to 46.7 in December. Economists had expected a reading of 48.2. Together the services and manufacturing sectors account for more than two-thirds of Europe’s largest economy. The German economy had contracted in the third quarter as well. A technical recession is defined as two straight quarters of decline. Business activity in the services sector dropped off for the third consecutive month, from 49.6 to a reading of 48.4 in December. Analysts forecasted a reading of 49.8. The manufacturing PMI rose from 42.6 to 43.1 this month, which was slightly below analysts’ 43.2 forecast. The survey showed that new orders had continued to contract. “If you are on the hunt for gifts right now, you will not strike gold in the latest PMI survey for Germany,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. “This confirms our view of a second consecutive quarter of negative growth by the year’s close,” Rubia added.

In France, business activity declined more rapidly than expected in December. The HCOB France flash Purchasing Managers Index (PMI) for the services sector, compiled by S&P Global, was at 44.3 points in December. The flash manufacturing PMI fell from 42.9 in November to 42.0 points. The flash December composite PMI – which is composed of both the services and manufacturing sectors – dropped from 44.6 in November to 43.7 points. “The French economy is sinking into the recession quagmire, with HCOB Flash PMIs painting a disconcerting picture in December of the second-largest EU economy. Both the services and sector contractions have intensified compared to the previous month,” said Tariq Kamal Chaudhry, an economist at Hamburg Commercial Bank. “French industry, in particular, expressed concerns about future prospects. Domestic and international orders are plummeting, signaling trouble for employment as job losses extended,” Chaudhry added.

China’s new home prices dropped for the fifth consecutive month in November, data from the National Bureau of Statistics (NBS) showed. The property sector had weakened as home buyer sentiment worsened and indebted developers weighed down sales and investment. Property investment fell 9.4% year-over-year, between manufacturing January to November. Industrial output advanced 6.6% last month year-over-year, which marked the strongest growth since September of last year. “We think that officials are underestimating the extent to which China’s slowdown is structural in nature and won’t be so easily reversed,” said Julian Evans-Pritchard, head of China economics at Capital Economics, in a note to clients. Economists had expected a 5.6% increase. Retail sales rose 10.1% in November but missed analysts’ expectations for a 12.5% rise. “Transactions are typically depressed towards the end of the year, and the property sector in general does not want to take on more leverage and house prices are still too high compared to urban incomes,” said Dan Wang, chief economist at Hang Seng Bank China. “People will just wait out this downward spiral,” Wang added.

Japan’s core machinery orders climbed for the second consecutive month in October, Cabinet Office data showed. Core orders gained 0.7%, which surpassed economists’ forecast for a 0.5% increase. On a year-on-year basis, core orders slipped 2.2%. Economists had forecasted a drop of 5.1%. By sector, orders from manufacturers climbed 0.2% in October, due to an increase in orders for metal products. Service-sector orders rose 1.2% as real estate, alongside wholesale and retail industries, orders increased. Business sentiment at major Japanese manufacturers nearly hit a two-year high in the fourth quarter, a Bank of Japan survey showed. Improved morale among automakers after a boost in profits from easing supply constraints had lifted optimism. “The machinery orders are expected to recover at a modest pace because domestic demand is weaker than expected and the outlook for overseas economies is not bright,” said Masato Koike, economist at Sompo Institute Plus.

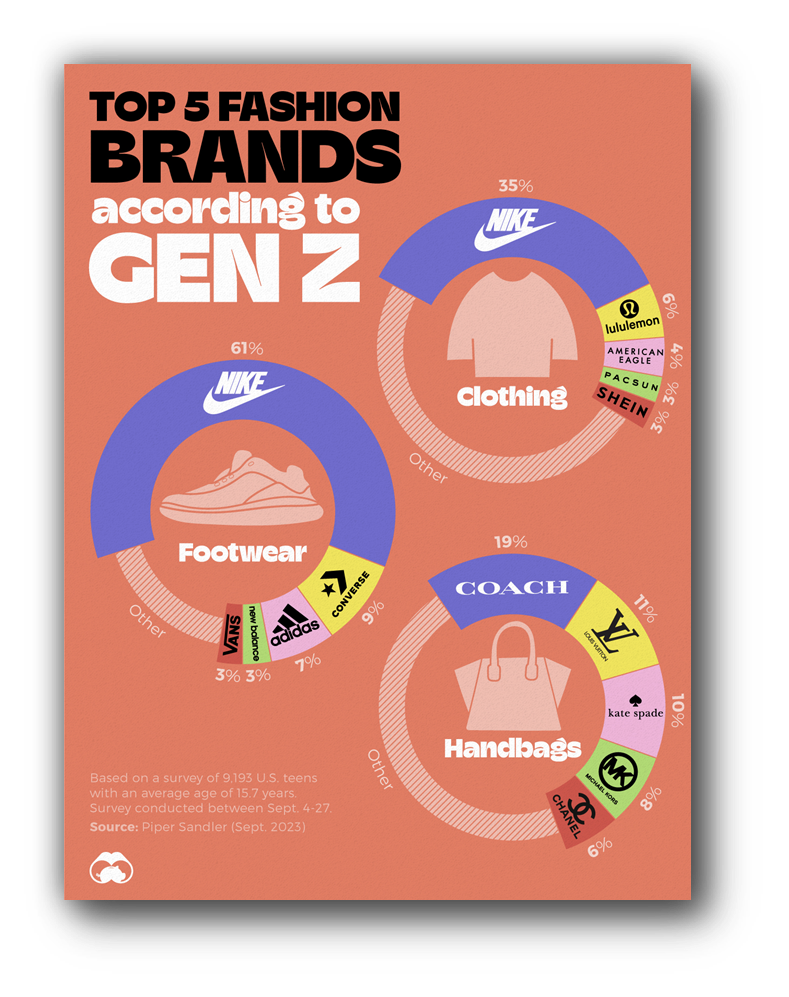

Finally: Do you often think about what you wear and why? It’s no secret that we are influenced by the people around us, whether we are consciously aware of it or not. More so than at any stage of your development, you are most influenced by your peers as a teenager. What brands do today’s teens like? Data from Piper Sandler elucidates Gen Z teens’ favorite brands of clothing, handbags, and shoes. The study surveyed 9,193 U.S. teens across a geographically diverse set of high schools in the third quarter of this year. In both clothing and shoes, Nike dominated the rankings in the study. In clothing, 35% of teens preferred Nike, followed by Lululemon at 6%. American Eagle and Pacsun ranked third and fourth at 4% and 3% respectively. Luxury brands sustained their grip on the handbag market, with the use of social media tools to attract Gen Z customers. Coach took the top spot at 19%, followed by Louis Vuitton (11%) and Kate Spade (10%). In shoes, Nike was the overwhelming favorite at 61%. Converse and adidas came in at 9% and 7% respectively. The survey further revealed that female spending had decreased by 1% year-on-year. Meanwhile, male fashion spending had increased. The values of companies, alongside their social media presence, were the top two components for a brand to attract greater Gen Z followings.

(Sources: All index- and returns-data from Norgate Data and Commodity Systems Incorporated; news from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet.)