The very big picture (a historical perspective): The CAPE is now at 34.77–down 4.56% this month

The long-term valuation of the market is commonly measured by the Cyclically Adjusted Price to Earnings ratio, or “CAPE”, which smooths-out shorter-term earnings swings in order to get a longer-term assessment of market valuation. In the past, the CAPE ratio has proved its importance in identifying potential bubbles and market crashes. An extremely high CAPE ratio means that a company’s stock price is substantially higher than the company’s earnings would indicate and, therefore, overvalued. It is generally expected that the market will eventually correct the company’s stock price by pushing it down to its true value. The historical average of the ratio for the S&P 500 Index is between 15-16, while the highest levels of the ratio have exceeded 30.

The record-high levels occurred three times in the history of the U.S. financial markets. The first was in 1929 before the Wall Street crash that signaled the start of the Great Depression. The second was in the late 1990s before the Dotcom Crash, and the third came in 2007 before the 2007-2008 Financial Crisis. https://www.multpl.com/shiller-pe

HISTORY OF THE CAPE VALUE FROM 1871 TO PRESENT

Note: We do not use CAPE as an official input into our methods. However, we think history serves as a guide and that it’s good to know where we are on the historic continuum. https://www.multpl.com/shiller-pe

The big picture: The ‘big picture’ is the (typically) years-long timeframe, the same timeframe in which Cyclical Bulls and Bears operate. The Sherman Portfolios DELTA-V Indicator measuring the Bull/Bear cycle finished the week in BULL status at 69.79, down 4.58% from the prior week’s 73.14. It has signaled Bull since April 21, 2023. The Sherman Portfolios DELTA-V Bond Indicator measuring the Bull/Bear cycle finished the week in BULL status at 70.73, up 2.24% from the prior week’s 69.18 It has signaled Bull since December 15, 2023.

The shorter term picture: GALACTIC SHIELD — POSITIVE entering July 2024 (Q3) indicating positive prospects for equities in the third quarter of 2024. This indicator is based on the combination of U.S. and International Equities trend statuses at the start of each quarter. STARFLUX— Positive since August 23, 2024. Starflux ended the week at 4.61 (down 49.45% last week) This short-term indicator measures U.S. Equities. STARPATH — POSITIVE since November 10, 2023. This indicator measures the interplay on dual timeframes of our Type 1s + the Russell 3000 + our four most ‘pro-cyclical’ Type 3s, vs. Cash.

The complete picture (four indicators across three timeframes): When all four of the Sherman Portfolios indicators are in a POSITIVE status, we read the market as being in a CYCLICAL BULL MARKET.

1. DELTA-V — Positive

2. GALACTIC SHIELD — Positive

3. STARFLUX— Positive

4. STARPATH — Positive

THIS WEEK IN THE MARKETS

U.S. Markets: Markets Down from Tech. The S&P 500 Index experienced its steepest weekly decline in 18 months, fueled by concerns over an economic slowdown. Information technology stocks, particularly NVIDIA, led the downturn, as rumors of a potential Justice Department antitrust investigation contributed to a significant drop in the company’s market value by around USD 300 billion. Energy stocks also struggled due to falling oil prices, while defensive sectors like utilities, consumer staples, and real estate fared better. Some attributed the decline to seasonal trading patterns, as September historically averages a 0.7% loss. Additionally, trading volumes increased with the end of summer vacations and a holiday-shortened week. The economic calendar added to the gloom, with weaker-than-expected data, including a report from the Institute for Supply Management showing continued contraction in U.S. manufacturing activity, raising fears that the Federal Reserve might have delayed easing monetary policy for too long.

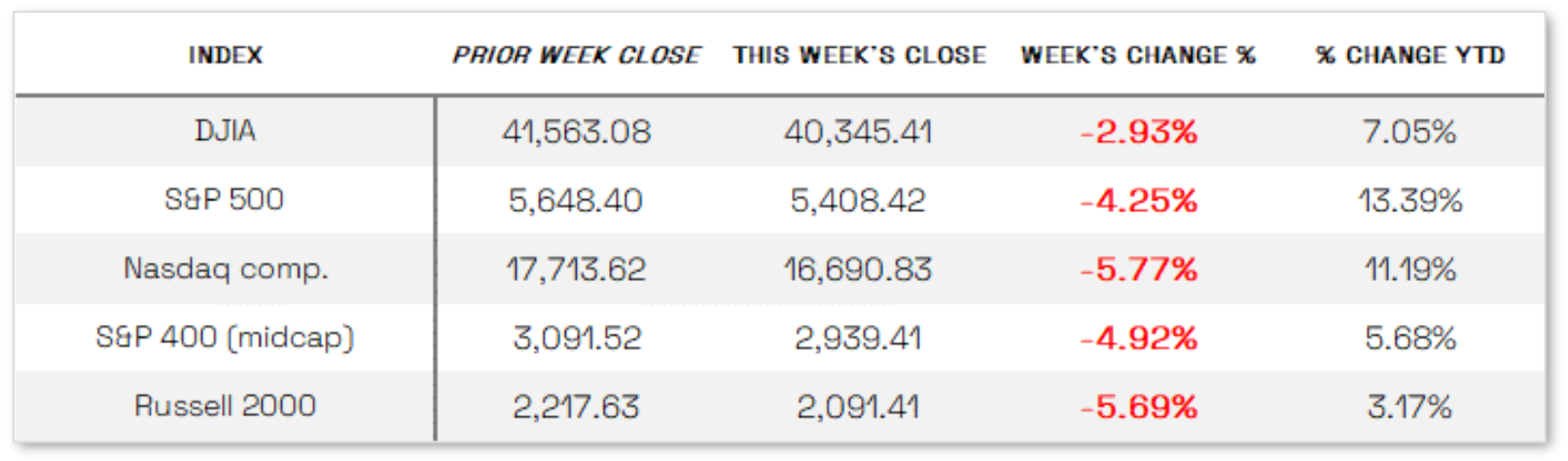

Looking at the US Indexes:

The Dow Jones Industrial Average (DJIA) is the oldest continuing U.S. market index with over 100 years of history and is made up of 30 highly reputable “blue-chip” U.S. stocks (e.g. Coca-Cola Co., Microsoft). The Dow showed a loss this week, ending the week down 2.93% to end at 40,345.41 vs the prior week of 41,563.08

The Nasdaq Composite Index tracks most of the stocks listed on the Nasdaq Stock Market – the second-largest stock exchange in the world. Over half of all stocks on the NASDAQ are tech stocks. The tech-driven Nasdaq showed losses this week. NASDAQ was down 5.77% by closing this week, at 16,690.83 vs. the prior week of 17,713.62.

The S&P 500 large-cap index is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall. The S&P 500 was in the red this week. It was down 4.25%, closing at 5408.42 compared to last week’s 5648.40.

The S&P 400 mid-cap index is the benchmark index made up of 400 stocks that broadly represent companies with midrange market capitalization between $3.6 billion and $13.1 billion. It is used by investors as a gauge for market performance and directional trends in U.S. stocks. The S&P 400 mid-cap was in the red this week, down 4.92% by closing this week at 2939.41 versus the prior week of 3091.52.

The Russell 2000 (RUT) small-cap index measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a leading indicator of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. The Russel 2000 was down 5.69% for the week, closing at 2091.41 compared to last week’s 2217.63.

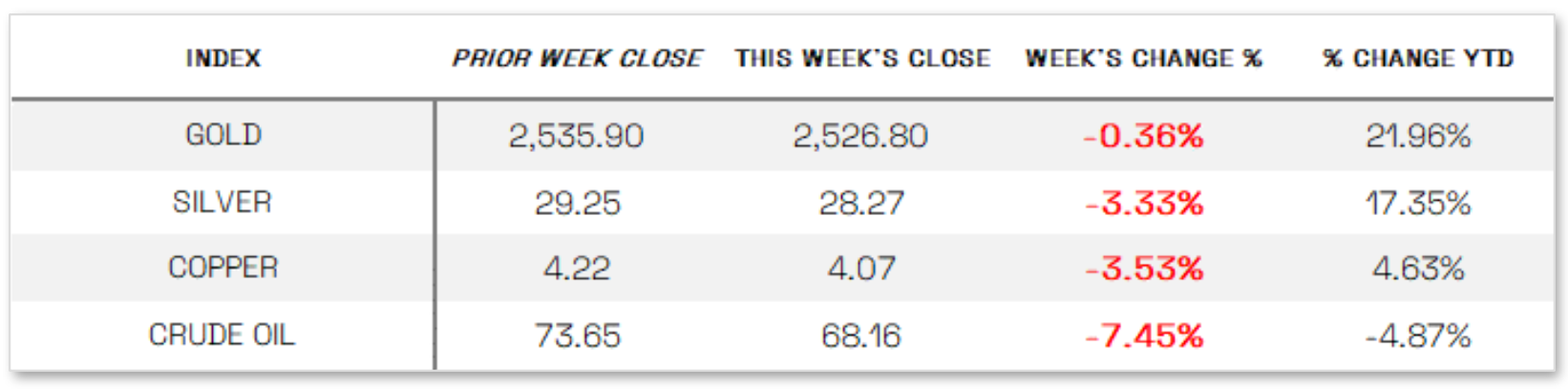

U.S. Commodities/Futures:

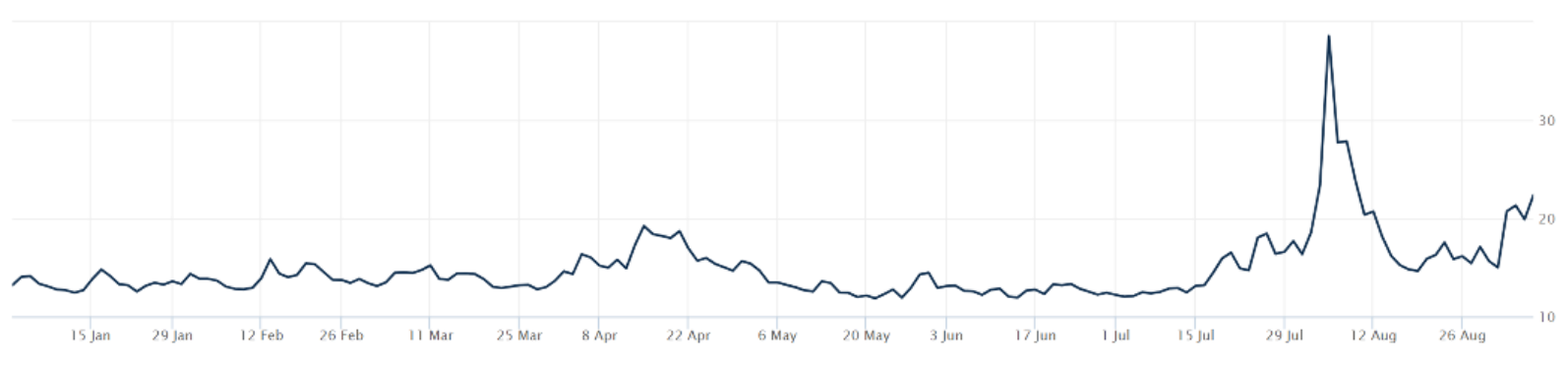

THE VOLATILITY INDEX for 2024 (VIX) closed at 22.38 this week, a 49.2% Increase vs last week’s close of 15.00.

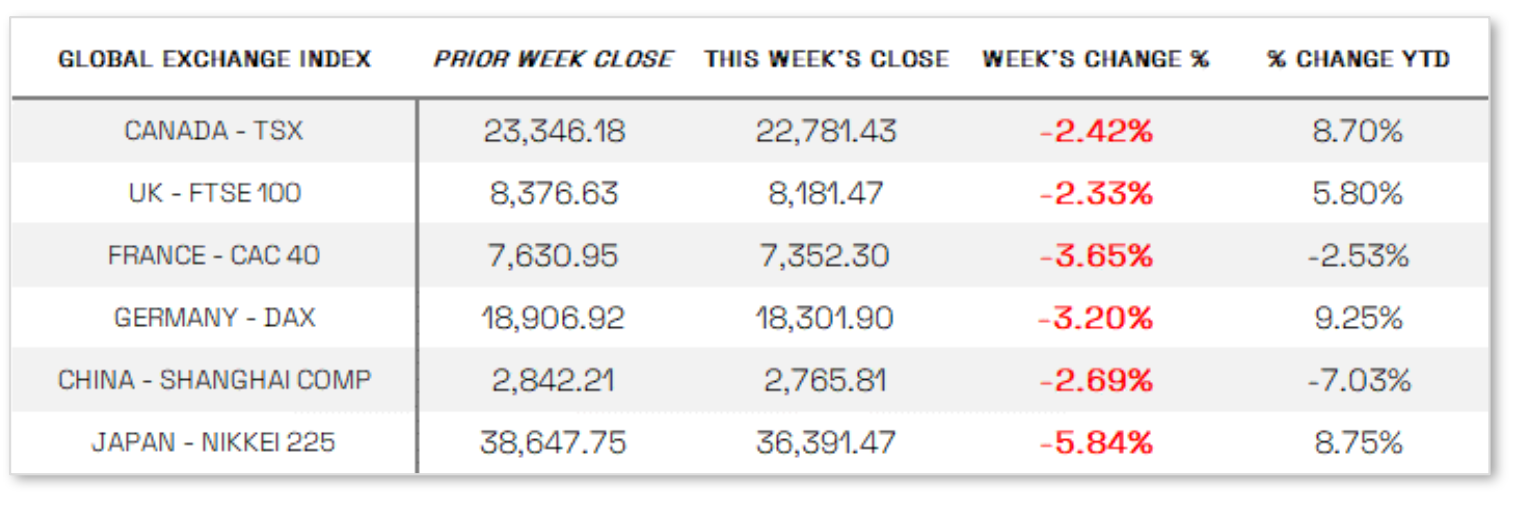

International Markets:

International Markets:

THIS WEEK’S ECONOMIC NEWS

U.S. Economic News: Mixed Job Data. Wednesday’s report from the Labor Department revealed that July job openings dropped to 7.67 million, the lowest since January 2021, marking a significant disappointment. The number of people voluntarily leaving their jobs, often seen as a strong indicator of labor market health, rose slightly but remained low after June’s downward revision to the lowest level since September 2020. On Thursday, ADP reported a modest increase of 99,000 private payrolls in August, far below expectations and the smallest gain since January 2021. The official payrolls report on Friday offered a mixed picture, with employers adding 142,000 jobs in August—below forecasts—while July’s figures were revised down to 89,000, the lowest since December 2020. However, the unemployment rate edged down from 4.3% to 4.2%, and average hourly earnings rose by 0.4%, exceeding expectations. Despite continued anticipation of a rate cut at the Federal Reserve’s September meeting, the jobs data tempered hopes for a substantial 50-basis-point cut. Interestingly, the yield on the 10-year U.S. Treasury note fell to its lowest level since May 2023 in response to the report. Meanwhile, U.S. Treasury yields declined more sharply than tax-free municipal yields, leading to more favorable muni-Treasury ratios. Traders noted that the near-term technical outlook weighed on municipal bonds as an uptick in new issues was expected, coupled with typically lighter reinvestment cash flows in the fall.

International Economic News: EUROPE: The pan-European STOXX Europe 600 Index fell 3.52% in local currency terms, driven by renewed concerns about global economic growth. Major European stock indexes also declined, with France’s CAC 40 dropping 3.65%, Germany’s DAX falling 3.20%, Italy’s FTSE MIB losing 3.15%, and the UK’s FTSE 100 sliding 2.33%. Yields on eurozone and UK government bonds broadly decreased. As for the European Central Bank (ECB), a rate cut in September appears likely, though views on future actions are mixed. ECB Governing Council member Gediminas Simkus indicated a clear case for a September rate cut, while doubting the likelihood of another in October, citing disinflation and sluggish growth as justifications. Meanwhile, Executive Board member Piero Cipollone noted that slowing inflation supports lowering borrowing costs, cautioning against overly restrictive policies. However, Bundesbank’s Joachim Nagel warned against premature easing due to ongoing wage growth and services inflation.

JAPAN: Japan’s stock markets declined over the week, with the Nikkei 225 Index dropping 5.84% and the broader TOPIX Index losing 4.2%. The markets took a sharp downturn midweek, driven by a U.S.-led sell-off in semiconductor stocks and a stronger yen, which created challenges for Japan’s export-focused companies. The yen appreciated to the mid-142 range against the USD from around JPY 145 the previous week, as expectations grew that the Bank of Japan (BoJ) might raise interest rates further this year, while the U.S. Federal Reserve appears poised to cut rates in September. Weak U.S. economic data raised recession fears, prompting investors to seek the safety of Japanese government bonds (JGBs), causing the 10-year JGB yield to fall to 0.86% from 0.90% despite solid wage growth in Japan. Real wages rose 0.4% year on year in July, supported by pay increases and summer bonuses, marking a second consecutive monthly gain and strengthening the case for further BoJ rate hikes. However, household spending remained sluggish, rising just 0.1% year on year in July despite the income growth.

CHINA: Chinese equities fell as investors reacted to weak corporate earnings and disappointing economic data. The Shanghai Composite Index dropped 2.69%, while the blue-chip CSI 300 declined 2.71%. In Hong Kong, the Hang Seng Index lost 3.03%, according to FactSet. China’s official manufacturing PMI decreased to 49.1 in August from 49.4 in July, reflecting deeper declines in production and new orders. This index has stayed below the 50-mark, indicating contraction, for most months since April 2023. The nonmanufacturing PMI, which tracks construction and services activity, slightly improved to 50.3 in August from 50.2 in July. Meanwhile, the private Caixin/S&P Global survey, focused on smaller export-oriented firms, showed manufacturing activity expanding to 50.4 from 49.8, as new orders grew. However, the Caixin services PMI fell to 51.6 from July’s 52.1, missing expectations due to weaker new work inflows and rising input costs. These mixed PMI readings underscored the uneven performance of China’s economy, which continues to struggle with a prolonged housing market slump and rising trade tensions. New home sales by the top 100 developers fell 26.8% in August year on year, worsening from a 19.7% drop in July, suggesting the diminishing impact of the government’s May real estate rescue package and sparking speculation about additional support measures from Beijing.

Sources: All index and returns All index and returns data from Norgate Data and Commodity Systems Incorporated and Wall Street Journal. >> News from Reuters, Barron’s, Wall St. Journal, Bloomberg.com, ft.com, guggenheimpartners.com, zerohedge.com, ritholtz.com, markit.com, financialpost.com, Eurostat, Statistics Canada, Yahoo! Finance, stocksandnews.com, marketwatch.com, visualcapitalist.com, wantchinatimes.com, BBC, 361capital.com, pensionpartners.com, cnbc.com, FactSet, Morningstar/Ibbotson Associates, Corporate Finance Institute. >> Commentary from T Rowe Price Global markets weekly update — https://www.troweprice.com/personal-investing/resources/insights/global-markets-weekly-update

Disclosures: This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any action. Past performance cannot guarantee future results.